Duck, an accrual basis corporation, sponsored a rock concert on December 29, 2022. Gross receipts were $300,000.

Question:

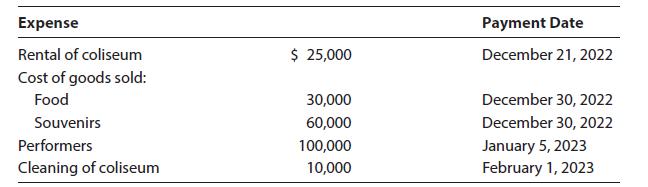

Duck, an accrual basis corporation, sponsored a rock concert on December 29, 2022. Gross receipts were $300,000. The following expenses were incurred and paid as indicated:

Because the coliseum was not scheduled to be used again until January 15, the company with which Duck had contracted did not perform the cleanup until January 8–10, 2023.

a. Calculate Duck’s net income from the concert for tax purposes for 2022.

b. Using the present value tables in Appendix E, what is the true cost to Duck if it had to defer the $100,000 deduction for the performers until 2023? Assume a 5% discount rate and a 21% marginal tax rate in 2022 and 2023.

Step by Step Answer:

South Western Federal Taxation 2023 Comprehensive Volume

ISBN: 9780357719688

46th Edition

Authors: Annette Nellen, Andrew D. Cuccia, Mark Persellin, James C. Young