John Parsons (123-45-6781) and George Smith (123-45-6782) are 70% and 30% owners, respectively, of Premium, Inc. (11-1111111),

Question:

Interest income........................................................................$ 100,000

Gross sales receipts.................................................................2,410,000

Beginning inventory........................................................................9,607

Direct labor................................................................................(203,102)

Direct materials purchased.....................................................(278,143)

Direct other costs.....................................................................(249,356)

Ending inventory.............................................................................3,467

Salaries and wages...................................................................(442,103)

Officers€™ salaries ($75,000 each to Parsons and Smith).......(150,000)

Repairs.......................................................................................(206,106)

Depreciation expense, tax and book.......................................(15,254)

Interest expense.........................................................................(35,222)

Rent expense (operating)..........................................................(40,000)

Taxes............................................................................................(65,101)

Charitable contributions (cash)................................................(20,000)

Advertising expenses................................................................(20,000)

Payroll penalties........................................................................(15,000)

Other deductions......................................................................(59,899)

Book income..............................................................................704,574

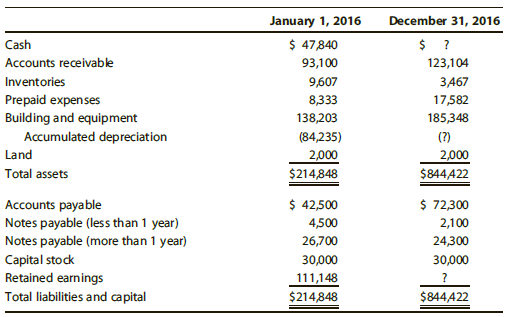

A comparative balance sheet appears below.

Premium€™s accounting firm provides the following additional information.

Distributions to shareholders............................................................$100,000

Beginning balance, Accumulated adjustments account.................$111,148

Using the preceding information, prepare a complete Form 1120S and Schedule K€“1s for John Parsons and George Smith, 5607 20th Street, Cut and Shoot, TX 77303. Do not complete the Form 4562. If any information is missing, make realistic assumptions.

Ending InventoryThe ending inventory is the amount of inventory that a business is required to present on its balance sheet. It can be calculated using the ending inventory formula Ending Inventory Formula =... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

South Western Federal Taxation 2018 Corporations Partnerships Estates And Trusts

ISBN: 1389

41st Edition

Authors: William H. Hoffman, William A. Raabe, James C. Young, Annette Nellen, David M. Maloney