Julie, a self-employed individual, is required to make estimated payments of her tax liability for the year.

Question:

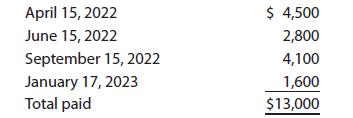

Julie, a self-employed individual, is required to make estimated payments of her tax liability for the year. Her tax liability for 2021 was $25,000, and her AGI was less than $150,000. For 2022, Julie ultimately determines that her income tax liability is $18,000. During the year, however, she made the following payments, totaling $13,000.

Because Julie prepaid so little of her ultimate income tax liability, she now realizes that she may be subject to the penalty for underpayment of estimated tax.

a. Determine Julie’s estimated tax underpayment for each installment period, if any.

b. Instead, assume that Julie’s tax liability for 2021 was $15,960.

Step by Step Answer:

South Western Federal Taxation 2023 Comprehensive Volume

ISBN: 9780357719688

46th Edition

Authors: Annette Nellen, Andrew D. Cuccia, Mark Persellin, James C. Young