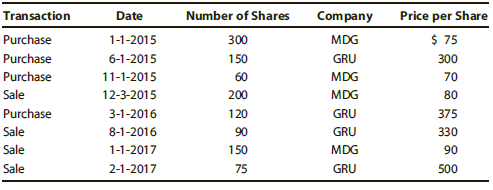

Karen Samuels (Social Security number 123-45-6789) makes the following purchases and sales of stock: Assuming that Karen

Question:

Assuming that Karen is unable to identify the particular lots that are sold with the original purchase, determine the recognized gain or loss on each type of stock:

a. As of July 1, 2015.

b. As of December 31, 2015.

c. As of December 31, 2016.

d. As of July 1, 2017.

e. Form 8949 and Schedule D (Form 1040) are used to report sales of capital assets (which include stock sales). Go to the IRS website, and download the 2016 Form 8949 and Schedule D (Form 1040). Then complete the forms for part (c) of this problem, assuming that the brokerage firm did not report Karen€™s basis to the IRS [complete Schedule D (Form 1040) through line 16].

Step by Step Answer:

South-Western Federal Taxation 2018 Comprehensive

ISBN: 9781337386005

41st Edition

Authors: David M. Maloney, William H. Hoffman, Jr., William A. Raabe, James C. Young