Max Martin (111-11-1111), David Dorn (123-45-6789), and Sandra Smith (987-65-4321) are, respectively, 55%, 35%, and 10% owners

Question:

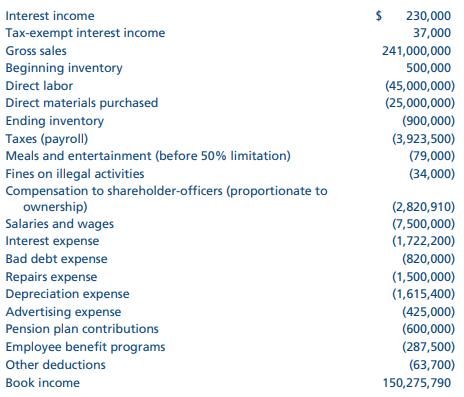

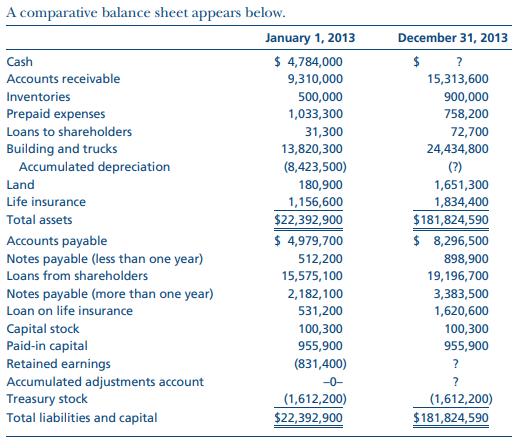

Max Martin (111-11-1111), David Dorn (123-45-6789), and Sandra Smith (987-65-4321) are, respectively, 55%, 35%, and 10% owners of Cotton, Inc. (12-3456789), a textile manufacturing company located at 1824 Church Street, Concord, NC 28025. The company’s first S election was made on January 1, 1999. The following information was taken from the financial income statement for 2013.

You must determine whether a Schedule M–3 is to be prepared. Cotton’s accounting firm and the corporate books and records provide the following additional information.

![]()

• Salaries and wages include $1.2 million of deferred compensation.

• Of the bad debt expense, $230,000 is not deductible this year.

• Of other expenses, $3,700 is permanently not deductible.

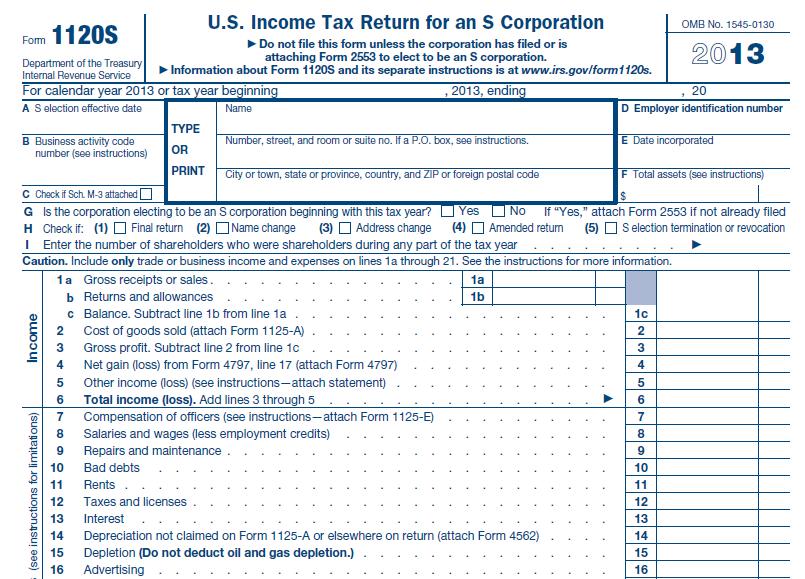

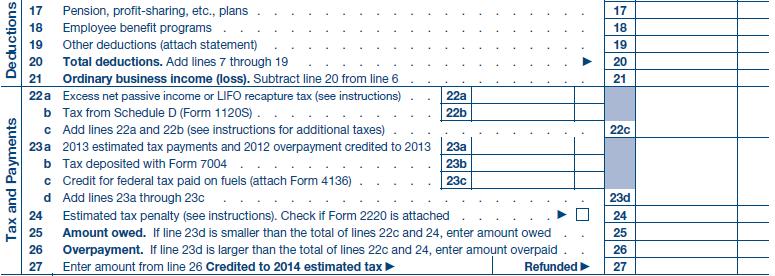

Using the preceding information, prepare a complete Form 1120S and a Schedule K–1 for Max Martin, 1824 Church Street, Concord, NC 28025. If any information is missing, make realistic assumptions.

Form 1120S:

Step by Step Answer:

South Western Federal Taxation 2015

ISBN: 9781305310810

38th Edition

Authors: William H. Hoffman, William A. Raabe, David M. Maloney, James C. Young