Roger Crocker, a U.S. citizen, died on July 1, 2015, leaving an adjusted gross estate that included

Question:

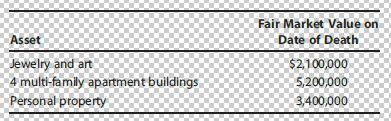

Roger Crocker, a U.S. citizen, died on July 1, 2015, leaving an adjusted gross estate that included the following assets.

Under the terms of Roger’s will, $3,400,000 of his personal property was bequeathed outright to his widow, free of estate and inheritance tax. The remainder of the estate was split equally among his three children. Roger made no other taxable gifts during his lifetime. In computing Roger’s taxable estate, the executor of the estate should claim marital deduction of:

a. $0

b. $3,400,000

c. $5,340,000

d. $5,430,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

South Western Federal Taxation 2017 Comprehensive

ISBN: 9781305874169

40th Edition

Authors: William H. Hoffman, David M. Maloney, William A. Raabe, James C. Young

Question Posted: