Rusty has been experiencing serious financial problems. His annual salary was $100,000, but a creditor garnished his

Question:

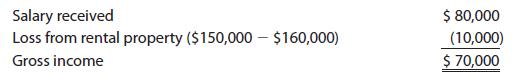

Rusty has been experiencing serious financial problems. His annual salary was $100,000, but a creditor garnished his salary for $20,000 [i.e., the employer paid the creditor (rather than Rusty) the $20,000]. To prevent creditors from attaching his investments, Rusty gave his investments to his 21-year-old daughter, Rebecca. Rebecca received $5,000 in dividends and interest from the investments during the year. Rusty transferred some cash to a Swiss bank account that paid him $6,000 interest during the year. Rusty did not withdraw the interest from the Swiss bank account. Rusty also hid some of his assets in his wholly owned corporation that received $150,000 rent income but had $160,000 in related expenses, including a $20,000 salary paid to Rusty. Rusty reasons that his gross income should be computed as follows:

Determine Rusty’s gross income for the year, and explain any differences between your calculation and Rusty’s.

Step by Step Answer:

South Western Federal Taxation 2023 Comprehensive Volume

ISBN: 9780357719688

46th Edition

Authors: Annette Nellen, Andrew D. Cuccia, Mark Persellin, James C. Young