The Tiller family has an adjusted gross income of $200,000 in 2022. The Tillers have two children,

Question:

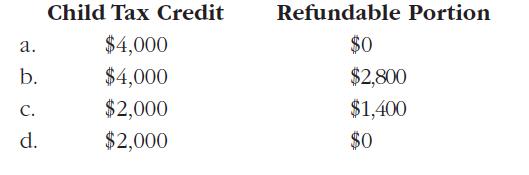

The Tiller family has an adjusted gross income of $200,000 in 2022. The Tillers have two children, ages 12 and 13, who qualify as dependents. All of the Tillers’ income is from wages. What is the Tillers’ child tax credit, and what portion of their child tax credit is refundable?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

South Western Federal Taxation 2023 Comprehensive Volume

ISBN: 9780357719688

46th Edition

Authors: Annette Nellen, Andrew D. Cuccia, Mark Persellin, James C. Young

Question Posted: