Xinran, who is married and files a joint return, owns a grocery store. In 2022, his gross

Question:

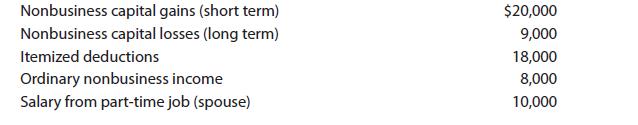

Xinran, who is married and files a joint return, owns a grocery store. In 2022, his gross sales were $276,000 and operating expenses were $320,000. Other items on his 2022 return were as follows:

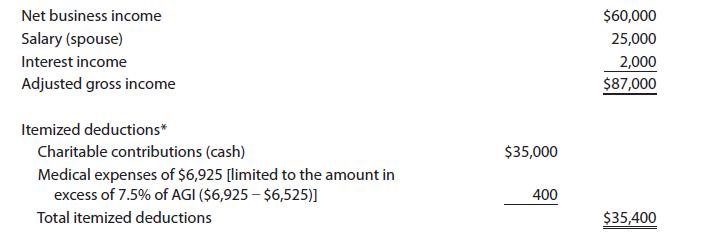

In 2023, Xinran provides the following information:

a. What is Xinran’s 2022 NOL?

b. Determine Xinran’s taxable income for 2023.

Transcribed Image Text:

Nonbusiness capital gains (short term) Nonbusiness capital losses (long term) Itemized deductions Ordinary nonbusiness income Salary from part-time job (spouse) $20,000 9,000 18,000 8,000 10,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (6 reviews)

a Business receipts Less Business expenses Net business loss Salary Ordinary nonbusiness income Nonbusiness shortterm capital gain Nonbusiness longter...View the full answer

Answered By

Ashington Waweru

I am a lecturer, research writer and also a qualified financial analyst and accountant. I am qualified and articulate in many disciplines including English, Accounting, Finance, Quantitative spreadsheet analysis, Economics, and Statistics. I am an expert with sixteen years of experience in online industry-related work. I have a master's in business administration and a bachelor’s degree in education, accounting, and economics options.

I am a writer and proofreading expert with sixteen years of experience in online writing, proofreading, and text editing. I have vast knowledge and experience in writing techniques and styles such as APA, ASA, MLA, Chicago, Turabian, IEEE, and many others.

I am also an online blogger and research writer with sixteen years of writing and proofreading articles and reports. I have written many scripts and articles for blogs, and I also specialize in search engine

I have sixteen years of experience in Excel data entry, Excel data analysis, R-studio quantitative analysis, SPSS quantitative analysis, research writing, and proofreading articles and reports. I will deliver the highest quality online and offline Excel, R, SPSS, and other spreadsheet solutions within your operational deadlines. I have also compiled many original Excel quantitative and text spreadsheets which solve client’s problems in my research writing career.

I have extensive enterprise resource planning accounting, financial modeling, financial reporting, and company analysis: customer relationship management, enterprise resource planning, financial accounting projects, and corporate finance.

I am articulate in psychology, engineering, nursing, counseling, project management, accounting, finance, quantitative spreadsheet analysis, statistical and economic analysis, among many other industry fields and academic disciplines. I work to solve problems and provide accurate and credible solutions and research reports in all industries in the global economy.

I have taught and conducted masters and Ph.D. thesis research for specialists in Quantitative finance, Financial Accounting, Actuarial science, Macroeconomics, Microeconomics, Risk Management, Managerial Economics, Engineering Economics, Financial economics, Taxation and many other disciplines including water engineering, psychology, e-commerce, mechanical engineering, leadership and many others.

I have developed many courses on online websites like Teachable and Thinkific. I also developed an accounting reporting automation software project for Utafiti sacco located at ILRI Uthiru Kenya when I was working there in year 2001.

I am a mature, self-motivated worker who delivers high-quality, on-time reports which solve client’s problems accurately.

I have written many academic and professional industry research papers and tutored many clients from college to university undergraduate, master's and Ph.D. students, and corporate professionals. I anticipate your hiring me.

I know I will deliver the highest quality work you will find anywhere to award me your project work. Please note that I am looking for a long-term work relationship with you. I look forward to you delivering the best service to you.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

South Western Federal Taxation 2023 Comprehensive Volume

ISBN: 9780357719688

46th Edition

Authors: Annette Nellen, Andrew D. Cuccia, Mark Persellin, James C. Young

Question Posted:

Students also viewed these Business questions

-

Gus, who is married and files a joint return, owns a grocery store. In 2016, his gross sales were $276,000, and operating expenses were $320,000. Other items on his 2016 return were as follows:...

-

Gus, who is married and files a joint return, owns a grocery store. In 2017, his gross sales were $276,000, and operating expenses were $320,000. Other items on his 2017 return were as follows:...

-

Shown here is a list published by Electronics Weekly.com of the top five semiconductor companies in the United States by revenue ($ billions). a. Construct a bar chart to display these data. b....

-

What is the difference between functional requirements and nonfunctional requirements?

-

Using the data below (given in millions of $U.S.), compute GDP, national income, and net domestic product. Corporate profits 1,200 Gross private domestic investment 2,000 Consumption of nondurable...

-

Describe how ethical theories, principles, virtues, and values are helpful to caregivers and the ethics committee in resolving ethical dilemmas.

-

Bloom Company management predicts that it will incur fixed costs of $160,000 and earn pretax income of $164,000 in the next period. Its expected contribution margin ratio is 25%. Use this information...

-

Image transcription text v X aXcelerate - Learner + X - C A entryeducation.app.axcelerate.com/learner/course/class/13950840/mod/19654/assessment/14117890/run Q Item List All BSBTEC301 - Design and...

-

Denise Lopez, age 40, is single and has no dependents. She is employed as a legal secretary by Legal Services, Inc. She owns and operates Typing Services located near the campus of Florida Atlantic...

-

Andre acquired a computer on March 3, 2022, for $2,800. He elects the straight-line method for cost recovery. Andre does not elect immediate expensing under 179. He does not claim any available...

-

What are different types of fraud and identity theft techniques and potential ways to protect yourself?

-

The operating time until failure, in 100,000 hour units, of a hard disk that your company manufactures follows an exponential distribution, Exponential(2.5). (a) Simulate time-until-failure outcomes...

-

What are the three basic steps of the analysis process? Which step is sometimes skipped or done in a cursory fashion? Why?

-

What is the purpose of the requirements definition?

-

What is the difference between an as-is system and a to-be system?

-

What are the key deliverables that are created during analysis? What is the final deliverable from analysis, and what does it contain?

-

What are the types of marketable obligations issued by the Treasury?

-

On July 1, 2011, Flashlight Corporation sold equipment it had recently purchased to an unaffiliated company for $480,000. The equipment had a book value on Flashlights books of $390,000 and a...

-

Determine the effect on gross income in each of the following cases: a. Eloise received $150,000 in settlement of a sex discrimination case against her former employer. b. Nell received $10,000 for...

-

Ten years ago, Liam, who is single, purchased a personal residence for $340,000 and took out a mortgage of $200,000 on the property. In May of the current year, when the residence had a fair market...

-

Ten years ago, Liam, who is single, purchased a personal residence for $340,000 and took out a mortgage of $200,000 on the property. In May of the current year, when the residence had a fair market...

-

Wigit Construction has reviewed an RFP response and has reached an agreement with the seller. How should they communicate the quantity of goods and services they need and the price that will be paid?

-

what effect the Coronavirus had or currently has on your life as well as your family's life.

-

3. Complete: Function: End behavior: As x-00, f(x) Graph: As x 00, f(x) Roots (with multiplicity): Value of leading coefficient: 1 Domain: Range: Other: f(0) = 16 y 40 20 X -5 0 5

Study smarter with the SolutionInn App