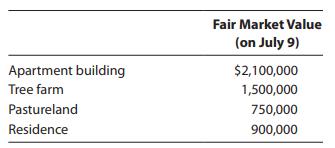

At the time of his death on July 9, Aiden held rights in the following real estate:

Question:

At the time of his death on July 9, Aiden held rights in the following real estate:

The apartment building was purchased by Chloe, Aiden’s mother, and is owned in a joint tenancy with her. The tree farm and pastureland were gifts from Chloe to Aiden and his two sisters. The tree farm is held in joint tenancy, and the pastureland is owned as tenants in common. Aiden purchased the residence and owns it with his wife as tenants by the entirety. How much is included in Aiden’s gross estate based on the following assumptions?

a. Aiden dies first and is survived by Chloe, his sisters, and his wife.

b. Aiden dies after Chloe, but before his sisters and his wife.

c. Aiden dies after Chloe and his sisters, but before his wife.

d. Aiden dies last (i.e., he survives Chloe, his sisters, and his wife).

Step by Step Answer:

South Western Federal Taxation 2018 Corporations Partnerships Estates And Trusts

ISBN: 1389

41st Edition

Authors: William H. Hoffman, William A. Raabe, James C. Young, Annette Nellen, David M. Maloney