RoofCo reports total book income before taxes of $32,000,000 and a total tax expense of $8,000,000. FloorCo

Question:

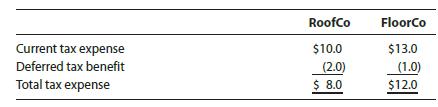

RoofCo reports total book income before taxes of $32,000,000 and a total tax expense of $8,000,000. FloorCo reports book income before taxes of $48,000,000 and a total tax expense of $12,000,000. The companies’ breakdown between current and deferred tax expense (benefit) is as follows:

RoofCo’s deferred tax benefit is created by the expected future use of a capital loss carryforward. FloorCo’s deferred tax benefit is related to a lawsuit that will not be settled until early next year. FloorCo’s lawyers predict that the company will probably lose the lawsuit. Compare and contrast these two companies’ effective tax rates. How are they similar? How are they different?

Step by Step Answer:

South-Western Federal Taxation 2022 Corporations, Partnerships, Estates And Trusts

ISBN: 9780357519240

45th Edition

Authors: William A. Raabe, James C. Young, Annette Nellen, William H. Hoffman