Using the facts of Problem 20, determine Minis 2021 deferred tax expense, total tax expense, and deferred

Question:

Using the facts of Problem 20, determine Mini’s 2021 deferred tax expense, total tax expense, and deferred tax assets and liabilities. In net present value terms, what has been the cost to Mini of the deferred tax deduction for bad debts? Use text Appendix E to calculate your answer.

Data from Problem 20

Mini, in Problem 18, reports $800,000 of pretax book net income in 2021. For that year, Mini did not recognize any bad debt expense for book purposes but did deduct $15,000 in bad debt expense for tax purposes. Mini reports no other temporary or permanent differences. Assuming that the U.S. tax rate is 21%, compute Mini’s current income tax expense.

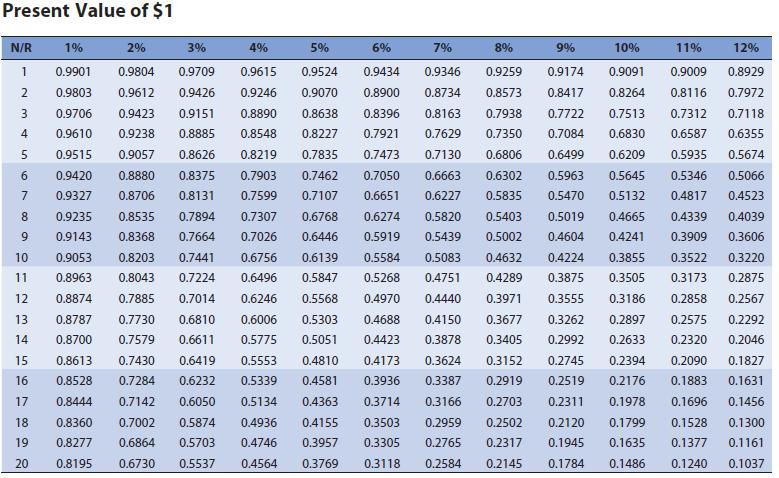

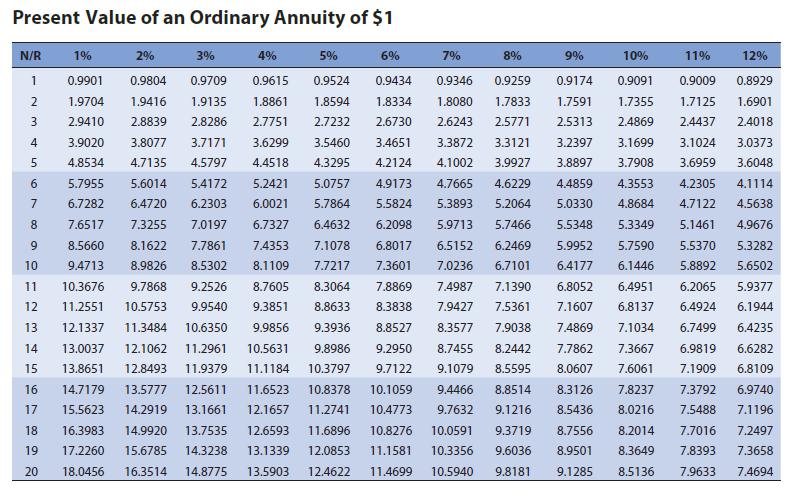

Data from Appendix E.

Present Value of $1 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 12% 1 0.9901 0.9709 0.9615 0.9346 0.9259 0.9174 0.9091 0.9009 0.8929 2 0.8734 0.8573 0.8417 0.8264 0.8116 0.7972 0.9804 0.9524 0.9434 0.9803 0.9612 0.9426 0.9246 0.9070 0.8900 0.9706 0.9423 0.9151 0.8890 0.8638 0.8396 0.8163 0.9238 0.8885 0.8548 0.8227 0.7921 0.7629 0.7350 0.7084 0.7938 0.7722 0.7513 0.7312 0.7118 0.6830 0.6587 0.6355 0.9610 0.9515 0.9057 0.8626 0.8219 0.7835 0.7473 0.7130 0.6806 0.6499 0.6209 0.5935 0.5674 0.9420 0.7462 0.7050 0.6663 0.6302 0.5963 0.5645 0.5346 0.5066 0.9327 0.8880 0.8375 0.7903 0.8706 0.8535 0.7894 0.6227 0.5835 0.5470 0.5132 0.4817 0.4523 0.9235 0.8131 0.7599 0.7107 0.6651 0.6274 0.5820 0.5919 0.5439 0.5002 0.7307 0.6768 0.5403 0.5019 0.4665 0.4339 0.4039 0.9143 0.8368 0.7664 0.7026 0.6446 0.4604 0.4241 0.3909 0.3606 0.3220 0.9053 0.8203 0.7441 0.6756 0.6139 0.3522 0.8963 0.8043 0.7224 0.6496 0.5847 0.5584 0.5083 0.4632 0.4224 0.3855 0.5268 0.4751 0.4289 0.3875 0.4440 0.3971 0.3555 0.3505 0.3173 0.2875 12 0.8874 0.7885 0.7014 0.6246 0.5568 0.4970 13 0.8787 0.7730 0.6810 0.6006 0.5303 0.4688 0.4150 0.3677 14 0.8700 0.7579 0.6611 0.5775 0.5051 0.4423 0.3878 0.3405 0.3624 0.3152 0.2745 0.3186 0.2858 0.2567 0.3262 0.2897 0.2575 0.2292 0.2992 0.2633 0.2320 0.2046 0.2394 0.2090 0.1827 0.2176 0.1883 15 0.8613 0.7430 0.6419 0.5553 0.4810 0.4173 16 0.8528 0.7284 0.6232 0.5339 0.4581 0.3936 0.1631 0.3387 0.2919 0.2519 0.3166 0.2703 0.2311 0.1978 17 0.8444 0.7142 0.6050 0.5134 0.4363 0.3714 0.1696 0.1456 18 0.8360 0.7002 0.5874 0.4936 0.2120 0.1799 0.1528 0.1300 19 0.8277 0.4155 0.3503 0.2959 0.2502 0.6864 0.5703 0.4746 0.3957 0.3305 0.2765 0.2317 0.6730 0.5537 0.4564 0.3769 0.3118 0.2584 0.2145 0.1945 0.1635 0.1377 0.1161 20 0.8195 0.1784 0.1486 0.1240 0.1037 N/R 3 4 5 6 7 8 9 10 11

Step by Step Answer:

To determine its deferred tax expense Mini must identify its deferred tax assets and liabilities Its ...View the full answer

South-Western Federal Taxation 2022 Corporations, Partnerships, Estates And Trusts

ISBN: 9780357519240

45th Edition

Authors: William A. Raabe, James C. Young, Annette Nellen, William H. Hoffman

Students also viewed these Business questions

-

Using the facts of Problem 18, determine the 2015 end-of-year balance in Minis deferred tax asset and deferred tax liability balance sheet accounts. In problem Mini, in Problem 16, reports $800,000...

-

Mini, in Problem 12, reports $800,000 of pretax book net income in 2019. For that year, Mini did not deduct any bad debt expense for book purposes but did deduct $15,000 in bad debt expense for tax...

-

Mini, in Problem 18, reports $800,000 of pretax book net income in 2021. For that year, Mini did not recognize any bad debt expense for book purposes but did deduct $15,000 in bad debt expense for...

-

1. Is religious training mandatory at all of the schools in question? 2. Does the Court see inevitable church-state entanglements if the Board were allowed to exercise jurisdiction over teachers in...

-

Use the Wilcoxon matched-pairs signed rank test to determine whether there is a significant difference between the related populations represented by the matched pairs given here. Assume = .05....

-

Refer to CA5.1. Prepare a spreadsheet that proves using the economic order quantity minimizes total inventory ordering costs plus inventory carrying costs. Use Exhibit 5.3 as a guide. Do not round...

-

Maribel Baltazar was hired by clothing retail merchandiser Forever 21 in 2007. During the hiring process, Baltazar was given an 11-page document to sign, two pages of which contained an arbitration...

-

Huron Company produces a commercial cleaning compound known as Zoom. The direct materials and direct labor standards for one unit of Zoom are given below: During the most recent month, the following...

-

(30 Pts.) Convert the following for loop into a while loop n=[] For Loop for x in range(100,0,-1): if x%10==0: n.append(x) print(n) While Loop (Write your answer below)

-

Use guidestar.org or other sites to obtain the following information on the Denver Zoo. Locate the entitys website. Under what paragraph of 501(c) do you believe the organization is exempt from...

-

Using the facts of Problem 14, determine Prances 2020 deferred tax expense, total tax expense, and any deferred tax asset or liability. Data from Problem 14. Prance, Inc., earned pretax book net...

-

The balance sheets of Par Ltd. and Sub Ltd. on December 31, Year 1, are as follows: The fair values of the identifiable net assets of Sub on December 31, Year 1, are as follows: Assume that the...

-

Donald received the following annual returns from his investment: Year 1 8.2% Year 2 -8.3% Year 3 17.8% Year 4 8.8% Calculate the Standard deviation of returns. Round the answer to two decimals...

-

Solve for x. 17x+7=15 -4x Round your answer to the nearest thousandth. Do not round any intermediate computations.

-

Ali makes garments that are very popular. Units sold are anticipated as: Monthly Unit Sales October 1100 November 3,150 December 5,500 January 4,500 Total units sold 14,250 If seasonal production is...

-

If i weigh 130 pounds and i ate a dunkin donutsboston kreme donut (270 kcal) - how many miles do i have to run to burn off the energyequivalent to the donut? please show all work with units so i can...

-

1. Which social media marketing platform do you think is the most effective tool for marketing nowadays? Explain why? 2. When is the best date and time to launch a poster introducing a new footwear...

-

What do managers do in terms of functions, roles, and skills?

-

Define cultural intelligence. Cite the books or journal articles you found in Capella's library. Explain why cultural intelligence is important for HR practitioners and other organizational managers.

-

Keith's sole proprietorship holds assets that, if sold, would yield a gain of $100,000. It also owns assets that would yield a loss of $30,000. Keith incorporates his business using only the gain...

-

Keith's sole proprietorship holds assets that, if sold, would yield a gain of $100,000. It also owns assets that would yield a loss of $30,000. Keith incorporates his business using only the gain...

-

Keith's sole proprietorship holds assets that, if sold, would yield a gain of $100,000. It also owns assets that would yield a loss of $30,000. Keith incorporates his business using only the gain...

-

Your proposal should also include two appendices. Will consist of a strategy map that includes the elements below: Business need: Explain what is prompting this project and the need for action....

-

What are the key provisions of the Privacy Shield Framework agreement between the United States and the European Union?

-

Question 04 Following transactions took place in Ms.Asha's business, during the month of January 2024. 1) The owner invested money to the business Rs. 800,000 2) The business bought a machine worth...

Study smarter with the SolutionInn App