What is a guaranteed payment? How is it reported on Form 1065 and its various schedules? How

Question:

What is a guaranteed payment? How is it reported on Form 1065 and its various schedules? How is it reported to and by the partner? Describe ways in which a guaranteed payment for services differs from guaranteed payments for use of the partner’s capital.

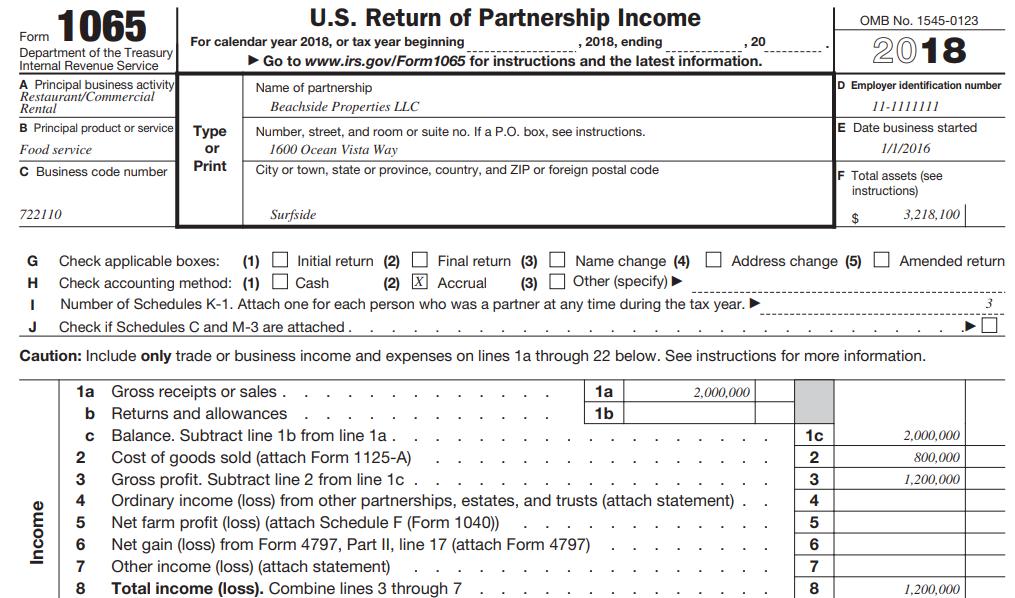

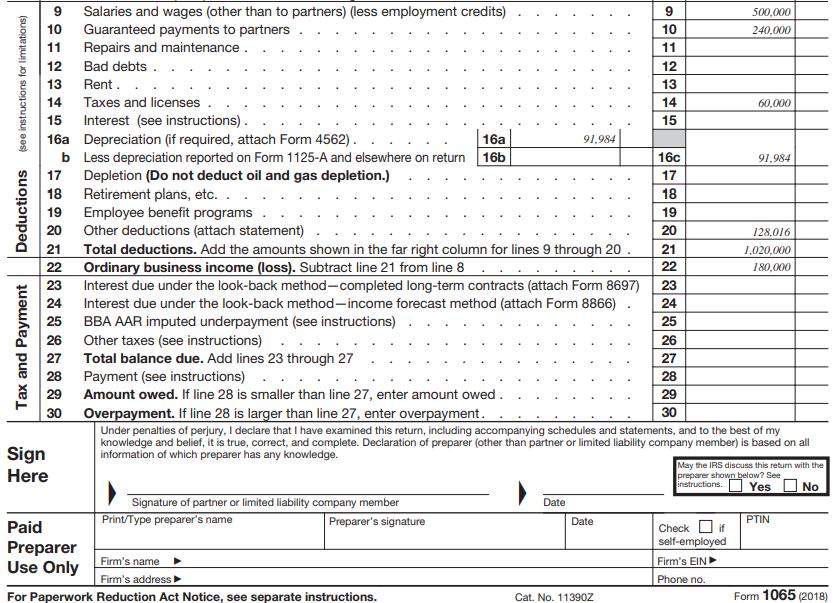

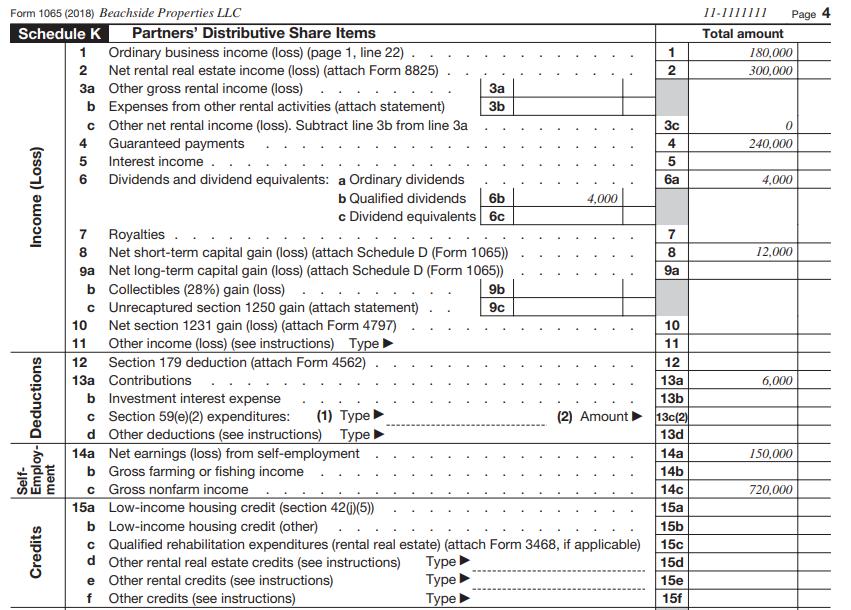

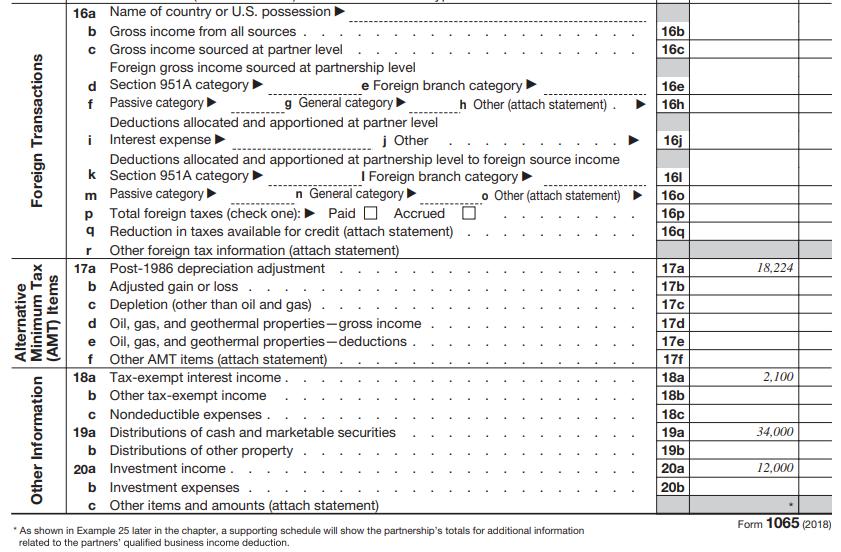

Form 1065

Transcribed Image Text:

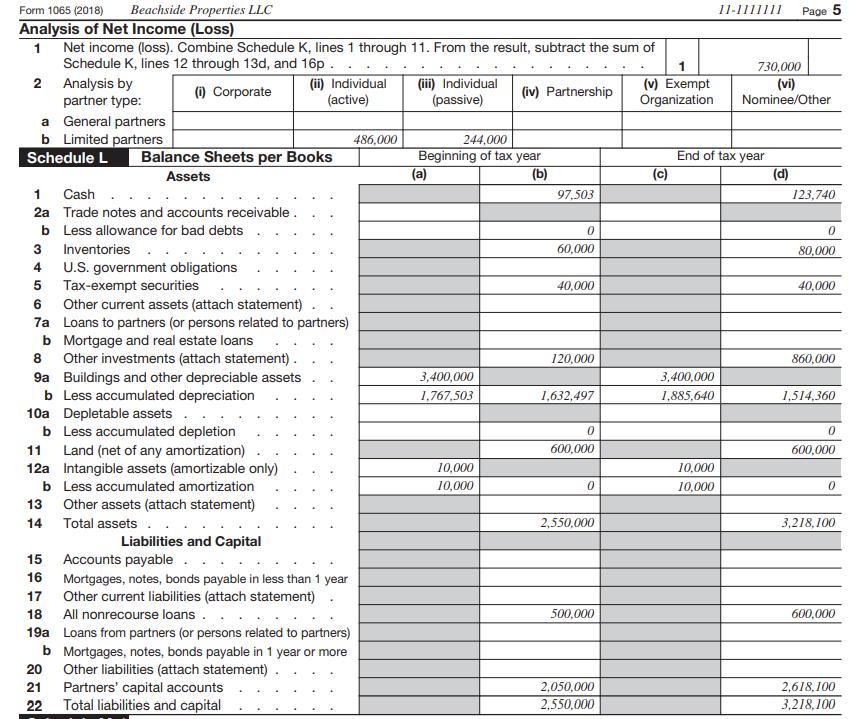

1065 U.S. Return of Partnership Income OMB No. 1545-0123 Form For calendar year 2018, or tax year beginning , 2018, ending , 20 2018 Department of the Treasury Internal Revenue Service A Principal business activity Restaurant/Commercial Rental ---------- Go to www.irs.gov/Form1065 for instructions and the latest information. D Employer identification number Name of partnership Beachside Properties LLC 11-1111111 B Principal product or service Туре Number, street, and room or suite no. If a P.O. box, see instructions. E Date business started Food service or 1600 Ocean Vista Way 1/1/2016 C Business code number Print City or town, state or province, country, and ZIP or foreign postal code Total assets (see instructions) 722110 Surfside $ 3,218,100 (1) O Initial return (2) L Final return (3) O Name change (4) D Address change (5) L Amended return (3) O Other (specify) G Check applicable boxes: H Check accounting method: (1) O Cash (2) X Accrual ---- Number of Schedules K-1. Attach one for each person who was a partner at any time during the tax year. J Check if Schedules C and M-3 are attached. Caution: Include only trade or business income and expenses on lines 1a through 22 below. See instructions for more information. 1a Gross receipts or sales. 1a 2,000,000 b Returns and allowances 1b C Balance. Subtract line 1b from line 1a. 1c 2,000,000 2 Cost of goods sold (attach Form 1125-A) Gross profit. Subtract line 2 from line 1c Ordinary income (loss) from other partnerships, estates, and trusts (attach statement) Net farm profit (loss) (attach Schedule F (Form 1040)) Net gain (loss) from Form 4797, Part II, line 17 (attach Form 4797) Other income (loss) (attach statement) 2 800,000 3 3 1,200,000 4 4 5 5 6 7 Total income (loss). Combine lines 3 through 7 8 1,200,000 Income

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 75% (4 reviews)

A guaranteed payment is a sum of money given to a partner by a partnership that is assured regardles...View the full answer

Answered By

Mary Boke

I have teached the student upto class 12th as well as my fellow mates.I have a good command in engineering,maths and science.I scored 90+ marks in 10th and 12th in maths.

0.00

0 Reviews

10+ Question Solved

Related Book For

South-Western Federal Taxation 2020 Comprehensive

ISBN: 9780357109144

43rd Edition

Authors: David M. Maloney, William A. Raabe, James C. Young, Annette Nellen, William H. Hoffman

Question Posted:

Students also viewed these Business questions

-

Describe ways in which a guaranteed payment for services differs from guaranteed payments for use of the partners capital.

-

Describe the three ways in which corporations acquire funds for investment.

-

Describe ways in which Access is used in Accounting.

-

Day and Night formed an accounting partnership in 2014. Capital transactions for Day and Night during 2014 are as follows: Partnership net income for the year ended December 31, 2014; is $68,400...

-

What does it mean when we say that advertising is intended to persuade? How do different ads persuade in different ways?

-

The following values are the times (in days) it took for prototype integrated circuits to fail. Test these values for normality, then replace each x value with log (x + 1) and test the transformed...

-

Who can conduct cost audit under the Companies Act, 2013?

-

With a smoothing constant of = 0.2, equation (6.2) shows that the forecast for the 13th week of the gasoline sales data from Table is given by F13 = 0.2Y12 + 0.8F12. However, the forecast for week...

-

A 250 MW coal-fired power plant has a heat rate of 9,300 BTUs. What is its 1st Law efficiency?

-

Ferrell Inc. recently reported net income of $6 million. It has 230,000 shares of common stock, which currently trades at $57 a share. Ferrell continues to expand and anticipates that 1 year from...

-

On an indirect method statement of cash flows, an increase in accounts payable is a. Deducted from net income in the operating activities section. b. Reported in the financing activities section. c....

-

On an indirect method statement of cash flows, a gain on the sale of plant assets is a. Added to net income in the operating activities section. b. Deducted from net income in the operating...

-

Which of the following factors are likely to support the conclusion that there is tacit collusion in this industry? Which are not? Explain. a. For many years the price in the industry has changed...

-

The owner of Oak Hill Squirrel Farm deposits \(\$ 1,000\) at the end of each quarter into an account paying 1.5\% compounded quarterly. What is the value at the end of 5 years, 6 months?

-

A TV game show selects three contestants from an audience of 80 people. If the same 80 people showed up, night after night, and no set of three contestants can be chosen more than once, how long...

-

In how many different ways can seven books be arranged on a shelf?

-

In Problems 23-34, find the value of each annuity at the end of the indicated number of years. Assume that the interest is compounded with the same frequency as the deposits. Amount of Deposit m 32....

-

Use a calculator to evaluate the amortization formula \[m=\frac{P\left(\frac{r}{n}ight)}{1-\left(1+\frac{r}{n}ight)^{-n t}}\] for the values of the variables \(P, r\), and \(t\) (respectively) given...

-

The Access database file Foodmart.mdb mentioned earlier has the tables and relationships shown in Figure 17.1. Import the tables into an Excel Data Model. Then create a pivot table that shows, for...

-

A routine activity such as pumping gasoline can be related to many of the concepts studied in this text. Suppose that premium unleaded costs $3.75 per gal. Work Exercises in order. Use the...

-

In each of the following independent situations, determine the dividends received deduction. Assume that none of the corporate shareholders owns 20% or more of the stock in the corporations paying...

-

In the current year, Riflebird Company had operating income of $220,000, operating expenses of $175,000, and a long-term capital loss of $10,000. How do Riflebird Company and Roger, the sole owner of...

-

In the current year, Riflebird Company had operating income of $220,000, operating expenses of $175,000, and a long-term capital loss of $10,000. How do Riflebird Company and Roger, the sole owner of...

-

How does lean production facilitate effective communication and collaboration across departments?

-

2. The idiophones in gamelan ensembles occur in pairs. The longest bar on a particular gamelan pair has a fundamental frequency (pitch) of 100Hz. Call this gamelan A. (a) (3 points) What are two...

-

The authors of The Creation of Inequality make the point that the Ice Age had barely thawed when some of our ancestors began "surrendering bits of equality." And that process unfolds across 15,000...

Study smarter with the SolutionInn App