Construct a 95 % confidence interval for the forecasts produced in question 48. Which model has the

Question:

Construct a 95 % confidence interval for the forecasts produced in question 48.

Which model has the larger interval? Use Eq. 14.21.

Eq. 14.21![]()

Question 48

Use the regression results from questions 23 and 24 to forecast the return for Ford in January 1988, using both the standard market model and the CAPM version of the market model. Assume that the return for the NYSE is 12 % in January 1988.

Question 24

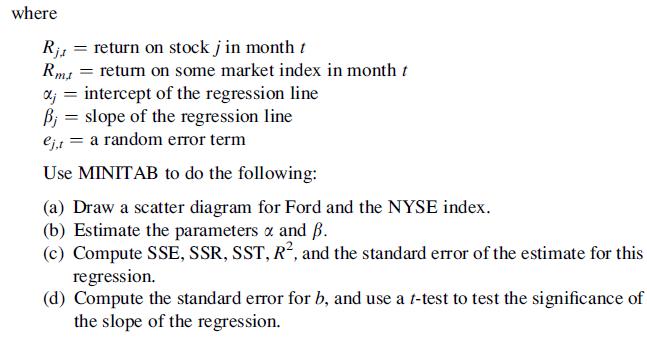

In finance, we sometimes choose to estimate the capital asset pricing (CAPM)

version of the market model, which is given by the equation![]()

where Rj,t is the return on a risk-free asset (such as T-bills) in month t. Repeat parts (a)–

(d) of question 23 for the CAPM version of the market model using the MINITAB program.

Question 23

In finance, we are often interested in how the return of one stock is related to some market index such as the NYSE. The model we usually estimate to understand this relationship is known as the market model and is given by the equation![]()

Step by Step Answer:

Statistics For Business And Financial Economics

ISBN: 9781461458975

3rd Edition

Authors: Cheng Few Lee , John C Lee , Alice C Lee