Financial ratio analysis is one of the best techniques for identifying and evaluating internal strengths and weaknesses.

Question:

Financial ratio analysis is one of the best techniques for identifying and evaluating internal strengths and weaknesses. Potential investors and current shareholders look closely at firms’ financial ratios, making detailed comparisons to industry averages and to previous periods of time. Financial ratio analyses provide vital input information for developing an IFE Matrix.

Instructions

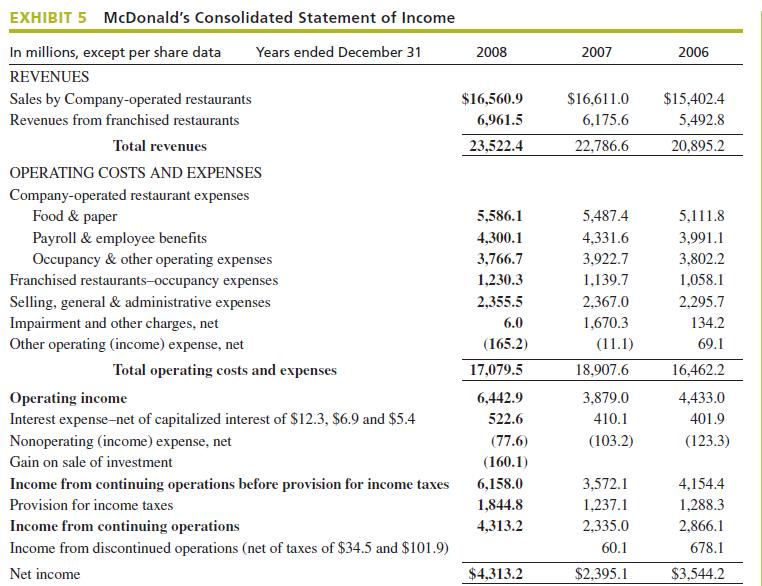

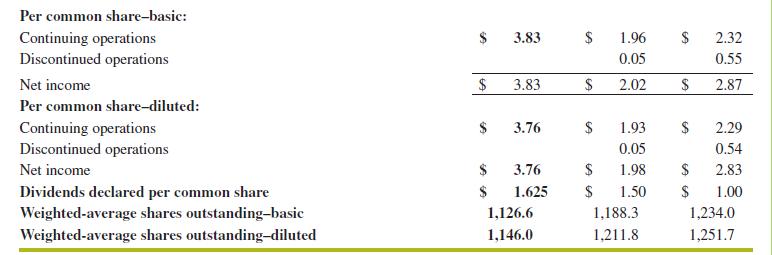

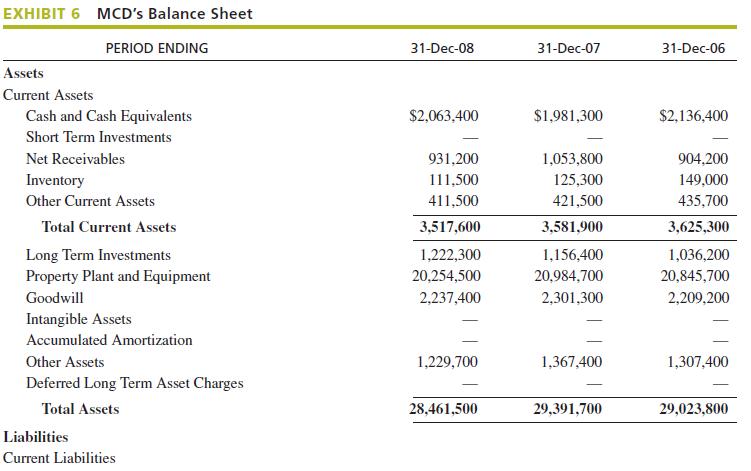

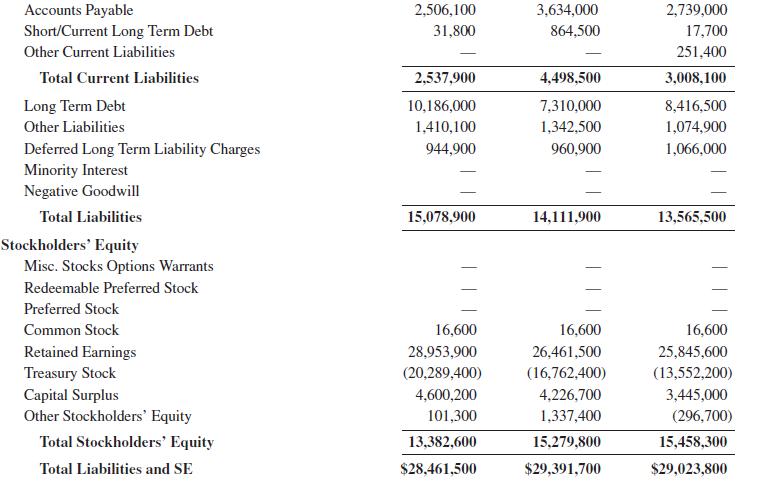

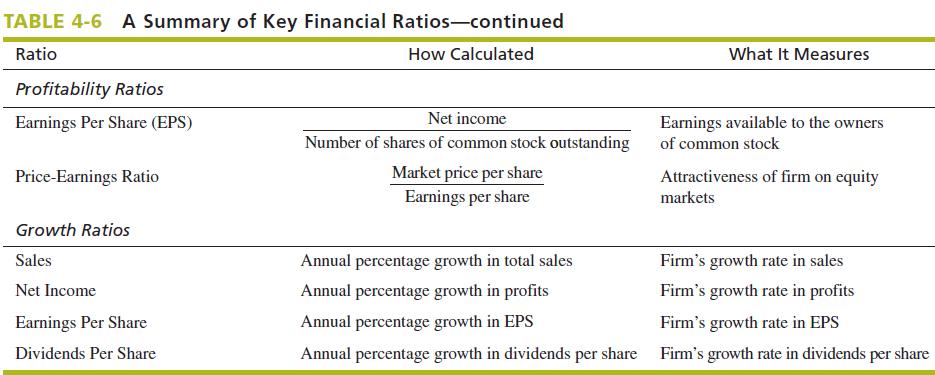

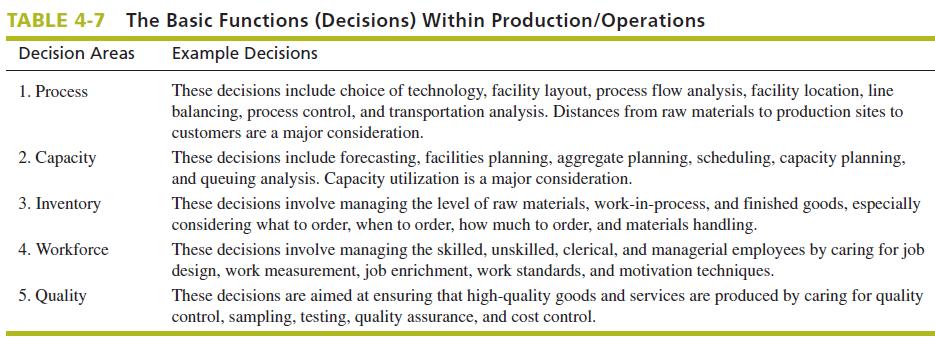

Step 1 On a separate sheet of paper, number from 1 to 20. Referring to McDonald’s income statement and balance sheet (pp. 31–32), calculate 20 financial ratios for 2008 for the company. Use Table 4-7 as a reference.

Step 2 In a second column, indicate whether you consider each ratio to be a strength, a weakness, or a neutral factor for McDonald’s.

Step 3 Go to the Web sites in Table 4-6 that calculate McDonald’s financial ratios, without your having to pay a subscription (fee) for the service. Make a copy of the ratio information provided and record the source. Report this research to your classmates and your professor.

Data from McDonald’s income statement and balance sheet

Table 4-6

Table 4-7

Step by Step Answer:

Strategic Management Concepts And Cases A Competitive Advantage Approach

ISBN: 9780136120988

13th Edition

Authors: Fred R. David