It is simply good business practice to periodically determine the financial worth or cash value of your

Question:

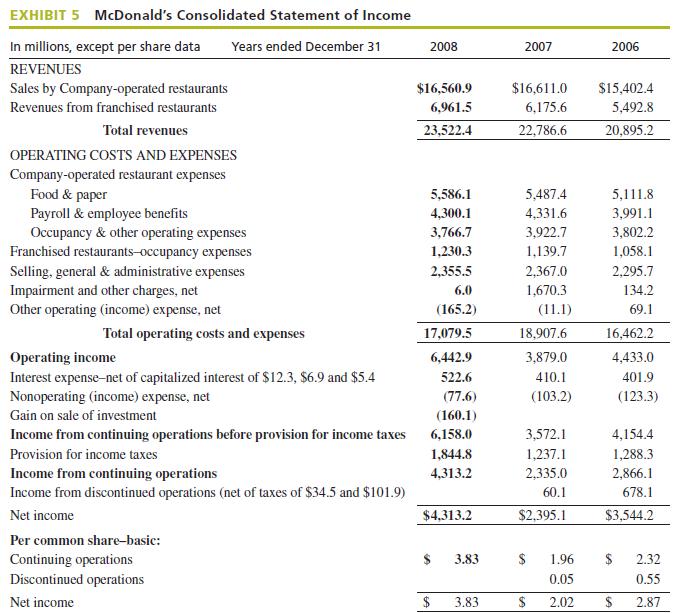

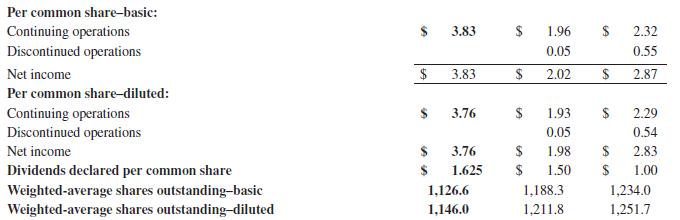

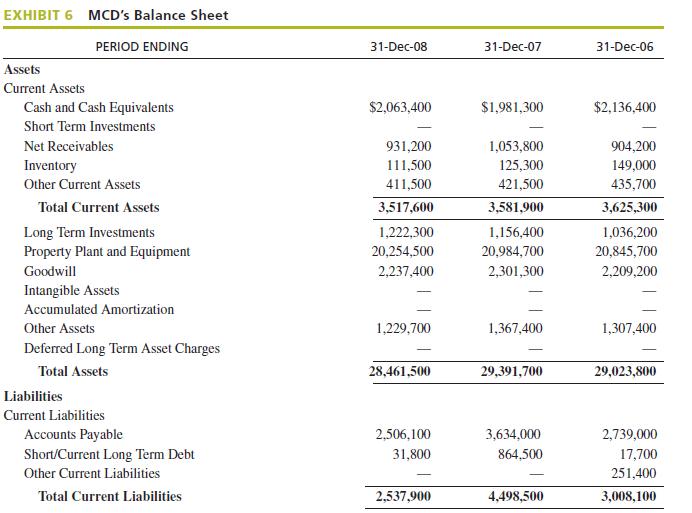

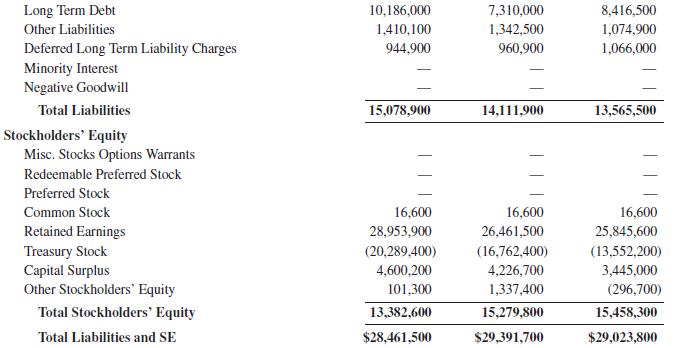

It is simply good business practice to periodically determine the financial worth or cash value of your company. This exercise gives you practice determining the total worth of a company using several methods. Use year-end 2008 data as given in the Cohesion Case on pages 31–32.

Instructions

Step 1 Calculate the financial worth of McDonald’s based on four methods:

(1) The net worth or stockholders’ equity,

(2) The future value of McDonald’s earnings,

(3) The price-earnings ratio,

(4) The outstanding shares method.

Step 2 In a dollar amount, how much is McDonald’s worth?

Step 3 Compare your analyses and conclusions with those of other students.

Data from pages 31–32

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Strategic Management Concepts And Cases A Competitive Advantage Approach

ISBN: 9780136120988

13th Edition

Authors: Fred R. David

Question Posted: