The discovery and crafting of drugs dates back to antiquity, however, small-scale production began in the late

Question:

The discovery and crafting of drugs dates back to antiquity, however, small-scale production began in the late eighteenth century. This was followed in the mid-nineteenth century by mass production and the founding of firms including Merck, Squibb, Upjohn, Pfizer and Eli Lilly in the USA; Sandoz, Hoffman LaRoche in Switzerland; Bayer, Hoechst in Germany; Beecham, Wellcome in the UK; and Clin-Byla in France. At the beginning of the twentieth century, some of the early players opened foreign subsidiaries that were mainly transatlantic. The First World War, which began on 28 July 1914 and ended on 11 November 1918, put a stop to the trend. In the 1920s, foreign expansion restarted. Despite this, by the end of the Second World War in 1945, the industry was a collection of national domestic players exporting products and producing in a small number of foreign subsidiaries.

The discovery of penicillin and insulin changed the industry’s economics. It marked the need for capital to fund research and development (R&D)

as well as the industrial assets of production. After the 1950s, there were three major developments:

1) the increasing cost of R&D, coupled with the birth of biotechnologies; 2) the concentration of the industry through mergers and acquisitions;

and 3) the globalization of production. The 1970s to the 1990s marked the end of patent protection that led to the development of generics and the birth of biotechnologies.

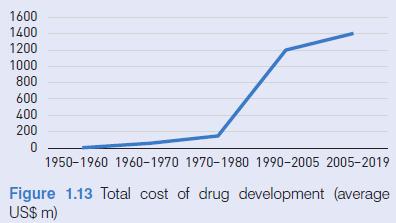

1 R&D Figure 1.13 shows the evolution of R&D costs. It illustrates the increasing capital required for the

discovery, testing, approval and commercialization of drugs. The figures are averages and the ranges can be high. For instance, for the period between 2005–2019 the average cost is $1,400 million, but the range varies from $670 million for anti-infective drugs, to $6,000 million for cancer immunotherapies.

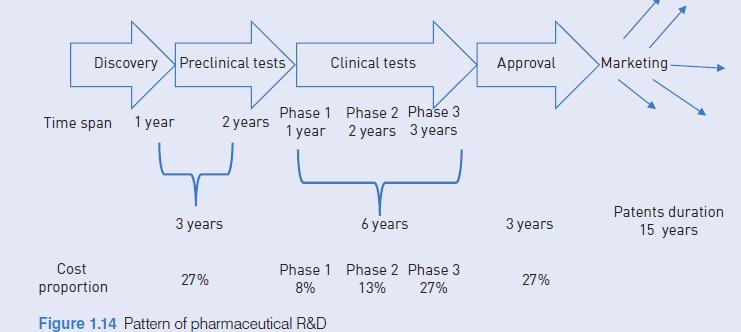

In addition to the large sums required, drug development is also a lengthy process. The pattern of drug development is shown in Exhibit 1.14. The time to recoup initial investment is relatively short during the period of patent protection (fifteen years) compared with the development time (twelve years). This encouraged firms to enlarge their markets and open subsidiaries or acquire companies. In addition to the increase in R&D, new technologies based on biotechnologies emerged forcing traditional pharmaceuticals to invest in their development either internally or through acquisition or alliances with biotech firms.

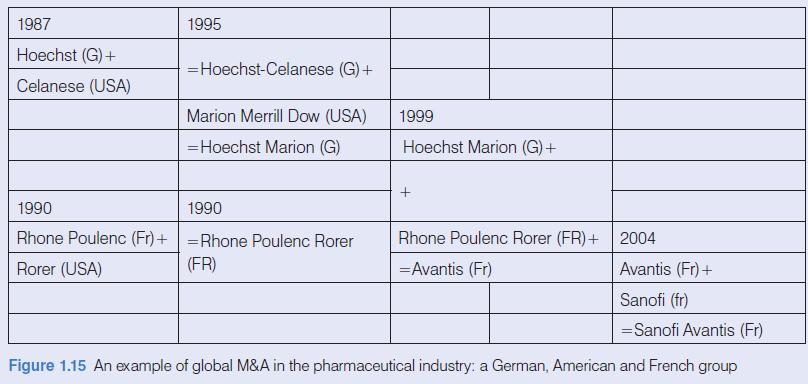

2 Mergers and acquisitions The concentration of pharmaceutical firms followed two trends: First, domestic mergers such as the

creation of Novartis that resulted from the merger of four Swiss companies: Sandoz, Ciba-Geigy, Hexal and Chiron. Similar examples include SmithKline and Beecham with Glaxo in the UK. Second, global mergers illustrated in Figure 1.15 with the creation of Sanofi (France, Germany, USA).

From 1999 to 2020, there was a large increase in global mergers and acquisitions, in particular with the acquisition of biotechnologies and genetic engineering firms.

Questions 1 Have R&D costs fostered the globalization of the industry? Why/why not?

2 What is the benefit for a pharmaceutical company in dispersing its R&D facilities?

3 Why have emerging countries invested in the production of generics?

4 Why did it take less than one year to discover and produce a vaccine for Covid-19, when normally the average time to produce a new drug is estimated at twelve years, as shown in Figure 1.14?

Step by Step Answer:

Global Strategic Management

ISBN: 9781350932968

5th Edition

Authors: Philippe Lasserre, Felipe Monteiro