The Hong Kong and Shanghai Banking Corporation was created in Shanghai in 1865. Its primary business was

Question:

The Hong Kong and Shanghai Banking Corporation was created in Shanghai in 1865. Its primary business was to finance trade with China. Up until the Second World War, it expanded rapidly in the Asia Pacific region (Japan, Malaysia, the Philippines and Thailand), with only a limited presence in the USA and Europe. After 1950, the bank embarked on a series of acquisitions in Europe (UK, France), the Middle East, Latin America (Mexico, Argentina, Brazil) and the USA. It listed on the New York, London, Paris and Hong Kong stock exchanges, and also moved its corporate headquarters from Hong Kong to London in 1993. In 1999 it adopted the name HSBC and positioned itself as ‘the world’s local bank’, defining itself as a global bank with strong local presence and knowledge. The principal holding company, HSBC Holdings plc, is a public limited company incorporated in England. HSBC has a matrixed management structure organized according to its global businesses and global support functions.

These are underpinned by the legal entity structure, which is made up of a global network of locally incorporated subsidiary companies that provide oversight at a country and regional level. Each of these subsidiaries has a board and management structure that reflects its activities and complexity.

To strengthen accountability and flows of information, there are seven principal subsidiaries that are responsible for the oversight of Group companies in their region and accountable to the board of HSBC Holdings plc.

HSBC’s structure is also influenced by the regulatory framework that applies to it. Many of the Group’s entities are locally regulated. While HSBC Holdings plc is not itself a regulated entity, it owns – directly or indirectly – a number of operating subsidiaries that are regulated and supervised as banks, insurance companies or securities firms in the countries and territories where they operate. In addition, the HSBC Group is subject to the consolidated supervision of the UK Prudential Regulation Authority.

It is the largest bank in Europe, with total assets of $2.715 trillion (as of August 2020). Its network comprises 3,900 offices in sixty-five countries and territories across Africa, Asia, Oceania, Europe, North America, and South America, and around 38 million customers.

HSBC is organized within four business groups:

Commercial Banking, Global Banking and Markets

(investment banking), Retail Banking and Wealth Management, and Global Private Banking. In 2020, the bank announced that it would consolidate its Retail Banking and Wealth Management arm with Global Private Banking, to form Wealth & Personal Banking. As of 30 October 2020, it had a market capitalisation of £66.1 billion ($90.1 billion [as of January 2022]).

The bank has developed a strategy of building networks within the world’s largest and fastest growing trade corridors (streams of products, services and information moving between geographic entities)

and economic zones. The company states that:

‘Our network of businesses covers the world’s largest and fastest growing trade corridors and economic zones. More than 43 per cent of our client revenue derives from businesses and individuals with an international presence’ (http://www.hsbc.com/

about-hsbc/our-strategy/the-value-of-our-network).

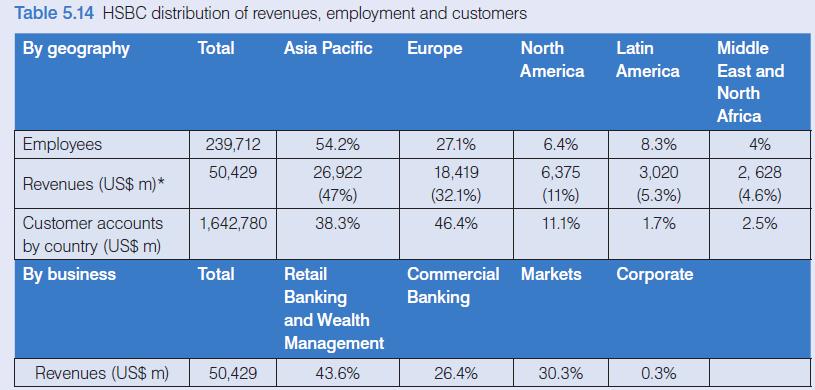

The distribution of the bank’s net income and profit before tax are given in Table 5.14.

Questions:

1 The bank defines its businesses as ‘global’.

What is your opinion of this definition? Are all the businesses really global? What are the implications for decision making?

2 What is your assessment of HSBC’s strategy of focusing on trade corridors?

Step by Step Answer:

Global Strategic Management

ISBN: 9781350932968

5th Edition

Authors: Philippe Lasserre, Felipe Monteiro