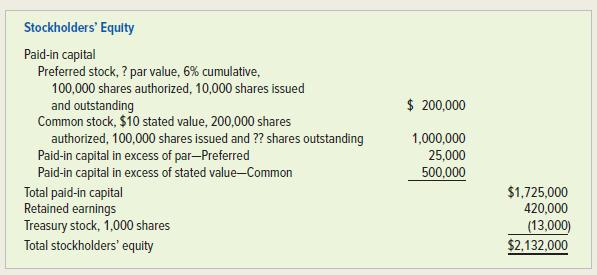

The stockholders equity section of the balance sheet for Mann Equipment Co. at December 31, Year 2,

Question:

The stockholders’ equity section of the balance sheet for Mann Equipment Co. at December 31, Year 2, is as follows.

The market value per share of the common stock is $42, and the market value per share of the preferred stock is $26.

Required

a. What is the par value per share of the preferred stock?

b. What is the dividend per share on the preferred stock?

c. What is the number of common stock shares outstanding?

d. What was the average issue price per share (price for which the stock was issued) of the common stock?

e. Explain the difference between the average issue price and the market price of the common stock.

f. If Mann Equipment Company declared a 2-for-1 stock split on the common stock, how many shares would be outstanding after the split? What amount would be transferred from the Retained Earnings account because of the stock split? Theoretically, what would be the market price of the common stock immediately after the stock split?

Step by Step Answer:

Survey Of Accounting

ISBN: 9781260575293

6th Edition

Authors: Thomas Edmonds, Christopher Edmonds, Philip Olds