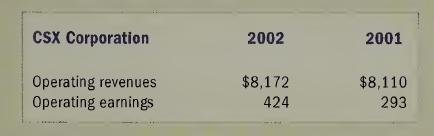

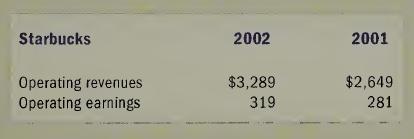

The following information was taken from the Form 10-K SEC filings for CSX Corporation and Starbucks Corporation.

Question:

The following information was taken from the Form 10-K SEC filings for CSX Corporation and Starbucks Corporation. It is from the 2002 fiscal year reports, and all dollar amounts are in millions.

CSX Corporation (CSX or the Company) operates one of the largest rail networks in the United States and also provides intermodal transportation services across the United States and key markets in Canada and Mexico. Its marine operations include an international terminal services company and a domestic container-shipping company.

Starbucks Corporation (together with its subsidiaries, Starbucks or the Company) purchases and roasts high-quality whole bean coffees and sells them, along with fresh, rich-brewed coffees, Italian-style espresso beverages, cold blended beverages, a variety of pastries and confections, coffee-related accessories and equipment, a selection of premium teas, and a line of compact discs primarily through Company-operated retail stores.

At fiscal year-end, Starbucks had 3,496 Company-operated stores in 43 states, the District of Columbia, and five Canadian provinces (which comprise the Company’s North American Retail operating segment), as well as 322 stores in the United Kingdom, 33 stores in Australia, and 29 stores in Thailand.

Required:

a. Determine which company appears to have the higher operating leverage.

b. Write a paragraph or two explaining why the company you identified in Requirement a might be expected to have the higher operating leverage.

c. If revenues for both companies declined, which company do you think would likely experience the greatest decline in operating earnings? Explain your answer.

Step by Step Answer:

Survey Of Accounting

ISBN: 9780073526775

1st Edition

Authors: Thomas Edmonds, Philip Olds, Frances McNair, Bor-Yi Tsay