Herald Corporation, a calendar-year taxpayer, purchased the following business assets: a. If these assets were placed in

Question:

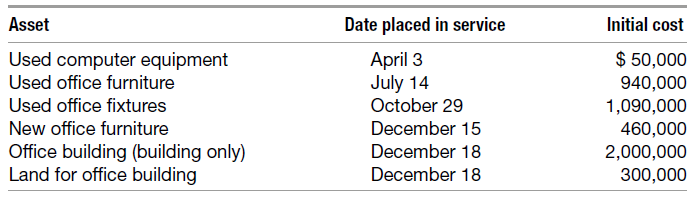

Herald Corporation, a calendar-year taxpayer, purchased the following business assets:

a. If these assets were placed in service in 2017, what is Herald Corporation’s depreciation deduction for 2017 if it makes any elections that will maximize its deduction?

b. If these assets were instead placed in service in 2018, what is Herald Corporation’s depreciation deduction for 2018 if it makes any elections that will maximize its deduction?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Taxation For Decision Makers 2019

ISBN: 9781119497288

9th Edition

Authors: Shirley Dennis Escoffier, Karen A. Fortin

Question Posted: