Monique is planning to increase the size of the manufacturing business that she operates as a sole

Question:

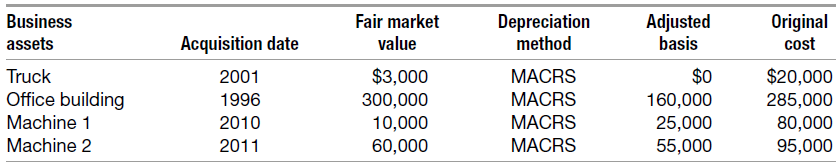

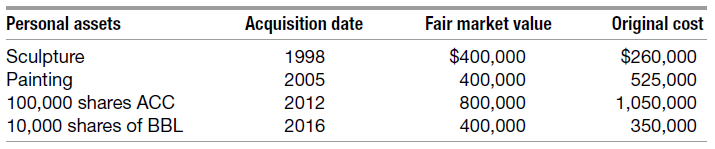

Monique is planning to increase the size of the manufacturing business that she operates as a sole proprietorship. She has a number of older assets that she plans to replace as part of the expansion. To finance this expansion she will have to sell some of her personal assets. Because it is close to the end of the tax year, she can time the sales of the assets to take the greatest advantage of the tax laws. Monique’s ordinary income of $600,000 currently places her in the 37 percent marginal tax bracket.

Following are the assets that Monique plans to sell; assume that she will realize their fair market value on the sales.

In addition to the proceeds from the sales of the business assets, Monique needs a minimum of an additional $800,000 for her planned expansion. Which assets should Monique sell to minimize her tax liability on the sales of the business and personal assets?

Step by Step Answer:

Taxation For Decision Makers 2019

ISBN: 9781119497288

9th Edition

Authors: Shirley Dennis Escoffier, Karen A. Fortin