In 2022, Sven is single and has $120,000 of regular taxable income. He itemizes his deductions as

Question:

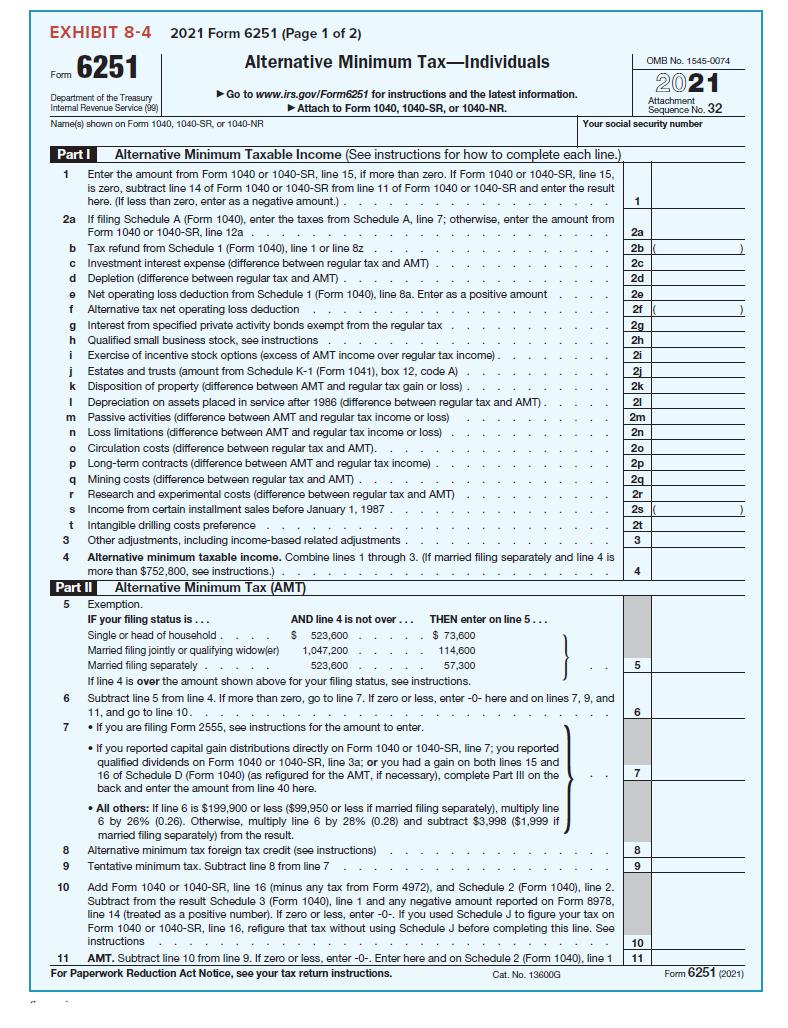

In 2022, Sven is single and has $120,000 of regular taxable income. He itemizes his deductions as follows: real property tax of $2,000, state income tax of $4,000, and mortgage interest expense of $15,000 (acquisition debt of $300,000). He also has a positive AMT depreciation adjustment of $500. What is Sven’s alternative minimum taxable income (AMTI)? Complete Form 6251 (through line 4) for Sven.

From 6251

Transcribed Image Text:

EXHIBIT 8-4 2021 Form 6251 (Page 1 of 2) Form 6251 Department of the Treasury Internal Revenue Service (99) Name(s) shown on Form 1040, 1040-SR, or 1040-NR b c d Part I Alternative Minimum Taxable Income (See instructions for how to complete each line.) Enter the amount from Form 1040 or 1040-SR, line 15, if more than zero. If Form 1040 or 1040-SR, line 15, is zero, subtract line 14 of Form 1040 or 1040-SR from line 11 of Form 1040 or 1040-SR and enter the result here. (If less than zero, enter as a negative amount.). ... 1 2a If filing Schedule A (Form 1040), enter the taxes from Schedule A, line 7; otherwise, enter the amount from Form 1040 or 1040-SR, line 12a. j k Alternative Minimum Tax-Individuals 1 I ►Go to www.irs.gov/Form6251 for instructions and the latest information. ► Attach to Form 1040, 1040-SR, or 1040-NR. e Net t operating loss deduction from Schedule 1 (Form 1040), line 8a. Enter as a positive amount Alternative tax net operating loss deduction f duction g Interest from specified private activity bonds exempt from the regular tax h Qualified small business stock, see instructions i Exercise of incentive stock options (excess of AMT income over regular tax income) Fa Estates and trusts (amount from Schedule K-1 (Form 1041), box 12, code A) Disposition of property (difference between AMT and regular tax gain or loss) Depreciation on assets placed in service after 1986 (difference between regular tax and AMT). m Passive activities (difference between AMT and regular tax income or loss) n Loss limitations (difference between AMT and regular tax income or loss) o Circulation costs (difference between regular tax and AMT). p Long-term contracts (difference between AMT and regular tax income) q Mining costs (difference between regular tax and AMT) r Research and experimental costs (difference between regular tax and AMT) s Income from certain installment sales before January 1, 1987. t Intangible drilling costs preference..... 3 Other adjustments, including income-based related adjustments Tax refund from Schedule 1 (Form 1040), line 1 or line 8z Investment interest expense (difference between regular tax and AMT) Depletion (difference between regular tax and AMT) 8 9 10 - ... 4 Alternative minimum taxable income. Combine lines 1 through 3. (If married filing separately and line 4 is more than $752,800, see instructions.) Part II Alternative Minimum Tax (AMT) 5 Exemption. IF your filing status is ... Single or head of household. ... Married filing jointly or qualifying widow(er) Married filing separately..... If line 4 is over the amount shown above for your filing status, see instructions. AND line 4 is not over... $ 523,600 1,047,200 523,600 THEN enter on line 5... $ 73,600 114,600 57,300 6 Subtract line 5 from line 4. If more than zero, go to line 7. If zero or less, enter -0- here and on lines 7, 9, and 11, and go to line 10... 7. If you are filing Form 2555, see instructions for the amount to enter. sen Your social security number • If you reported capital gain distributions directly on Form 1040 or 1040-SR, line 7; you reported qualified dividends on Form 1040 or 1040-SR, line 3a; or you had a gain on both lines 15 and 16 of Schedule D (Form 1040) (as refigured for the AMT, if necessary), complete Part III on the back and enter the amount from line 40 here. • All others: If line 6 is $199,900 or less ($99,950 or less if married filing separately), multiply line 6 by 26% (0.26). Otherwise, multiply line 6 by 28% (0.28) and subtract $3,998 ($1,999 if married filing separately) from the result. Alternative minimum tax foreign tax credit (see instructions) Tentative minimum tax. Subtract line 8 from line 7 Add Form 1040 or 1040-SR, line 16 (minus any tax from Form 4972), and Schedule 2 (Form 1040), line 2. Subtract from the result Schedule 3 (Form 1040), line 1 and any negative amount reported on Form 8978, line 14 (treated as a positive number). If zero or less, enter -0-. If you used Schedule J to figure your tax on Form 1040 or 1040-SR, line 16, refigure that tax without using Schedule J before completing this line. See instructions..... ...... ... 11 AMT. Subtract line 10 from line 9. If zero or less, enter -0-. Enter here and on Schedule 2 (Form 1040), line 1 For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 13600G 1 2a 2b 2c 2d 2e 2f 2g 2h 21 2j 2k 21 2m 2n 20 2p 2q 2r 2s 2t 3 4 5 6 7 OMB No. 1545-0074 2021 Attachment Sequence No. 32 8 9 10 11 Form 6251 (2021)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 57% (7 reviews)

Svens AMTI is 126500 Description Amount Explanation 1 Regular taxable incom...View the full answer

Answered By

Branice Buyengo Ajevi

I have been teaching for the last 5 years which has strengthened my interaction with students of different level.

4.30+

1+ Reviews

10+ Question Solved

Related Book For

Taxation Of Individuals And Business Entities 2023 Edition

ISBN: 9781265790295

14th Edition

Authors: Brian Spilker, Benjamin Ayers, John Barrick, Troy Lewis, John Robinson, Connie Weaver, Ronald Worsham

Question Posted:

Students also viewed these Business questions

-

In 2014, Sven is single and has $120,000 of regular taxable income. He itemizes his deductions as follows: real property tax of $2,000, state income tax of $4,000, mortgage interest expense of...

-

In 2017, Sven is single and has $120,000 of regular taxable income. He itemizes his deductions as follows: real property tax of $2,000, state income tax of $4,000, mortgage interest expense of...

-

In 2015, Sven is single and has $120,000 of regular taxable income. He itemizes his deductions as follows: real property tax of $2,000, state income tax of $4,000, mortgage interest expense of...

-

A Hydrogen atom has one proton in the nucleus and one electron in the shell. In a classic model of the atom, in a certain state, this electron is in a circular orbit around the nucleus with an...

-

1. Attempt to draw the new Finance Department and the Hickory Handles organization chart as Mr. Whiteshirt has described it. 2. What problems exist with Mr. Whiteshirts concept?

-

A refrigerator used by a meat processor has a cost of $120,000, an estimated residual value of $14,000, and an estimated useful life of 16 years. What is the amount of the annual depreciation...

-

What does the phrase theory of the case mean? Why is it important to develop a theory of the case in advance of trial?

-

Valencia Products makes automobile radar detectors and assembles two models: LaserStop and SpeedBuster. The firm can sell all it produces. Both models use the same electronic components. Two of these...

-

In your words, explain why student loans have become a moral hazard problem for the USA. 2) Has the student loan also created a negative externality? If yes, explain. If no, provide your arguments....

-

Terry Corporation reported fair values for its minority-passive equity investment portfolio at the last four year-ends as shown in the table below. The company did not buy or sell any investments in...

-

Jennies grandmother paid her tuition this fall to State University (an eligible educational institution). Jennie is claimed as a dependent by her parents, but she also files her own tax return. Can...

-

In 2022, for a taxpayer with $50,000 of taxable income, without doing any actual computations, which filing status do you expect to provide the lowest tax liability? Which filing status provides the...

-

Casey Klemons' agreement (BELO plan) with his employer provides for a pay rate of $16.50 per hour with a maximum of 50 hours. How much would Klemons be paid for a week in which he worked 46 hours?

-

Why might a company hold low-yielding marketable securities when it could earn a much higher return on operating assets?

-

What does the MM theory with no taxes state about the value of a levered firm versus the value of an otherwise identical but unlevered firm? What does this imply about the optimal capital structure?

-

What is securitization? What are its advantages to borrowers? What are its advantages to lenders?

-

What are some inventory ordering costs? As defined here, are these costs fixed or variable?

-

What are some methods firms can use to accelerate receipts?

-

Why is it possible to understand the words spoken by two people at the same time?

-

5. Convert the following ERD to a relational model. SEATING RTABLE Seating ID Nbr of Guests Start TimeDate End TimeDate RTable Nbr RTable Nbr of Seats RTable Rating Uses EMPLOYEE Employee ID Emp...

-

Elvira is a self-employed taxpayer who turns 42 years old at the end of the year (2020). In 2020, her net Schedule C income was $130,000. This was her only source of income. This year, Elvira is...

-

Hope is a self-employed taxpayer who turns 54 years old at the end of the year (2020). In 2020, her net Schedule C income was $130,000. This was her only source of income. This year, Hope is...

-

Rita is a self-employed taxpayer who turns 39 years old at the end of the year (2020). In 2020, her net Schedule C income was $300,000. This was her only source of income. This year, Rita is...

-

Your Boss calls you to his office and asks a couple of questions that are basically not in sequence. What is the scaling technique used to build a distributed Streaming Analytics system such as...

-

Database systems cannot stand alone; they depend on many other systems. Choose an industry from e-commerce, healthcare, or banking and discuss database security for an organization in one of those...

-

Suppose you have this query SELECT Pname, Price, Color FROM PRODUCT WHERE Price < 50 OR Color = Red; Which technique can be used to improve this query ? Q2.With a neat state transition diagram...

Study smarter with the SolutionInn App