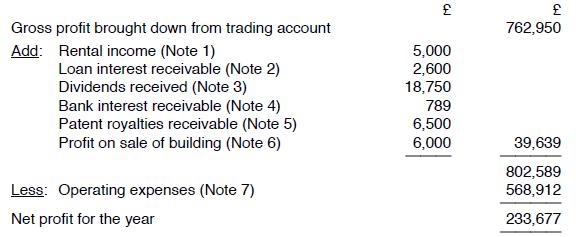

A company produces the following income statement for the year to 31 March 2021: Notes: 1. The

Question:

A company produces the following income statement for the year to 31 March 2021:

Notes:

1. The property was let on 1 January 2021 at a rent of £20,000 per annum, payable annually in advance. The figure shown in the income statement represents the rent for the period 1 January 2021 to 31 March 2021. No allowable expenditure has been incurred in relation to the let property.

2. Loan interest of £1,950 was received during the year and a further £650 was owing to the company at the end of the year. None was owed to the company at the start of the year. The income statement shows the total of £2,600.

3. Dividends of £18,750 were received from other UK companies during the year.

4. Bank interest received in the year was £684. Of this, £100 was owed to the company at the start of the year. A further £205 was owing to the company at the end of the year but was not received until April 2021.

5. Gross patent royalties of £6,000 were received in the year and a further £500 was owing to the company at the end of the year. None was owed to the company at the start of the year. The income statement shows the total of £6,500. These patents are held for trade purposes.

6. The chargeable gain on the sale of the building is £2,350.

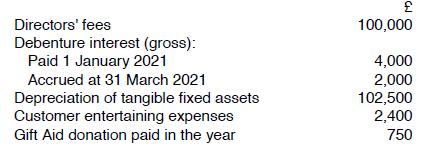

7. Operating expenses include:

All of the remaining operating expenses are allowable as trading expenses. The debentures were issued on 1 July 2020 for trade purposes. The company claims capital allowances for the year of £87,450.

Required:

(a) Compute the company's trading income for the year to 31 March 2021.

(b) Compute the company's taxable total profits for the year to 31 March 2021.

Step by Step Answer: