A sole trader's income statement for the year to 30 June 2020 shows an expense of 923

Question:

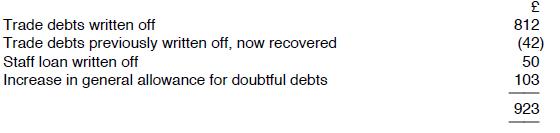

A sole trader's income statement for the year to 30 June 2020 shows an expense of £923 in relation to bad and doubtful debts. This expense comprises:

The staff loan written off was not made for trade purposes.

(a) How much of the £923 charged to the income statement for the year should be added back when computing trading profits for tax purposes?

(b) How would this differ if the allowance for doubtful debts was a specific allowance rather than a general allowance?

Transcribed Image Text:

Trade debts written off Trade debts previously written off, now recovered Staff loan written off Increase in general allowance for doubtful debts CH 812 (42) 50 103 923

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (2 reviews)

a The staff loan written off nontrade of 50 and the increase of 103 in the general ...View the full answer

Answered By

Shameen Tahir

The following are details of my Areas of Effectiveness. The following are details of my Areas of Effectiveness English Language Proficiency, Organization Behavior , consumer Behavior and Marketing, Communication, Applied Statistics, Research Methods , Cognitive & Affective Processes, Cognitive & Affective Processes, Data Analysis in Research, Human Resources Management ,Research Project,

Social Psychology, Personality Psychology, Introduction to Applied Areas of Psychology,

Behavioral Neurosdence , Historical and Contemporary Issues in Psychology, Measurement in Psychology, experimental Psychology,

Business Ethics Business Ethics An introduction to business studies Organization & Management Legal Environment of Business Information Systems in Organizations Operations Management Global Business Policies Industrial Organization Business Strategy Information Management and Technology Company Structure and Organizational Management Accounting & Auditing Financial Accounting Managerial Accounting Accounting for strategy implementation Financial accounting Introduction to bookkeeping and accounting Marketing Marketing Management Professional Development Strategies Business Communications Business planning Commerce & Technology Human resource management General Management Conflict management Leadership Organizational Leadership Supply Chain Management Law Corporate Strategy Creative Writing Analytical Reading & Writing Other Expertise Risk Management Entrepreneurship Management science Organizational behavior Project management Financial Analysis, Research & Companies Valuation And any kind of Excel Queries.

4.70+

16+ Reviews

34+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

The financial statements of JJ Ltd and KK Ltd for the year to 30 June 2018 are shown below: Statements of comprehensive income for the year to 30 June 2018. Statements of financial position as at 30...

-

Whilst preparing its financial statements for the year to 30 June 2020, a company discovers that (owing to an accounting error) the sales figure for the year to 30 June 2019 had been understated by...

-

Case H Pearson Air Conditioning & Service Managing a Firms Working Capital Brothers Scott and Bob Pearson, father, and son, are the owners of Pearson Air Conditioning & Service, based in...

-

What does this code print (unless it produces an error)? = plane "A passengers" plane [2] = "m" print (plane)

-

A truck covers 40.0 m in 8.50 s while smoothly slowing down to a final speed of 2.80 m/s. (a) Find its original speed. (b) Find its acceleration.

-

Suppose you have a light spring stretched out and one end is attached to a wall. With this setup, you can move the free end in any of three directions \((x, y, z)\). If the spring lies along, say,...

-

What is corporate governance?

-

Vegan, LLC, owns a chain of gourmet vegetarian take-out markets. Last month, Store P generated the following information: sales, $890,000; direct materials, $220,000; direct labor, $97,000; variable...

-

7. A vertical spring is fixed to one of its end and a massless plank fitted to the other end. A block is released from a height has shown. Spring is in relaxed position. Then choose the correct...

-

(a) A motor car with a retail price of 21,000 is leased for four years at a cost of 300 per month. The car is used only for trade purposes and has an emission rating of 112g/km. How much of the...

-

Jim is the managing director of a company and earns a basic salary in 2020-21 of 225,000. He receives benefits from the company during the year as follows: (a) He is provided with the use of a...

-

Discuss the importance of the role of the database administrator. In the flat-file environment, why is such a role not necessary? What tasks does the DBA perform?

-

AA Corporations stock has a beta of 8. The risk-free rate is 4.5% and the expected return on the market is 13.6%. What is the required rate of return on AAs stock? The market and Stock J have the...

-

Victor Korchnoi bought a bond one month before a semi-annual coupon was due. The face value was $10,000 and the coupon rate 8.5%. At the time of purchase there were 34 coupons left and the YTM was 6%...

-

A home mortgage authority requires a deposit on a home loan according to the following schedule: Loans in excess of $100 000 are not allowed. Design an algorithm that will read a loan amount and...

-

Given find dy

-

Suppose that the following processes arrive for execution at the times indicated. Each process will run for the listed amount of time. Process Arrival Time Service Time ITT a. Choose two out of the...

-

Joy Insurance decides to finance expansion of its physical facilities by issuing convertible debenture bonds. The terms of the bonds follow: maturity date 10 years after May 1, 2010, the date of...

-

Draw and label the E and Z isomers for each of the following compounds: 1. CH3CH2CH==CHCH3 2. 3. 4. CH,CH2C CHCH2CH Cl CH3CH2CH2CH2 CH CH2CCCH2CI CHCH3 CH3 HOCH CH CCC CH O-CH C(CH

-

A company adopts international standards for the first time when preparing its financial statements for the year to 30 June 2020. These financial statements show comparative figures for the previous...

-

Explain the term "generally accepted accounting practice" (GAAP). Is there just one GAAP which is accepted worldwide? If not, why not?

-

Outline the structure and functions of the following bodies: (a) The IFRS Foundation (b) The International Accounting Standards Board (c) The IFRS Advisory Council (d) The IFRS Interpretations...

-

Explanation of Contract Law

-

Predetermined Overhead Rates, Overhead Variances, Unit Costs Primera Company produces two products and uses a predetermined overhead rate to apply overhead. Primera currently applies overhead using a...

-

How does the media portrayal of nursing impact public perception of the nurse's role? How can your professional mannerisms, use of ethical principles, technology, and communication skills impact a...

Study smarter with the SolutionInn App