Anita starts trading on 1 July 2017, preparing accounts to 30 June. Her only acquisitions and disposals

Question:

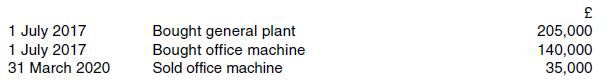

Anita starts trading on 1 July 2017, preparing accounts to 30 June. Her only acquisitions and disposals of plant and machinery in the first three years of trading are as follows:

Her AIA for the year to 30 June 2018 is set against the £20 5,000 expenditure on general plant. Compute capital allowances for the first three chargeable periods assuming that:

(a) she does not make any short-life elections

(b) she makes a short-life election with regard to the office machine.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: