Antietam Ltd makes up accounts to 30 September annually. Results for the 12 months to 30 September

Question:

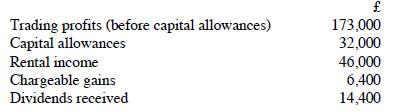

Antietam Ltd makes up accounts to 30 September annually. Results for the 12 months to 30 September 2020 are as follows:

The company has capital losses brought forward from previous accounting periods of £1,400 and made a Gift Aid donation of £20,000 during the year.

Required:

(a) Calculate the corporation tax liability of Antietam Ltd for the year to 30 September 2020 and state the due date of payment.

(b) What difference would it make if you were told that the company has nine subsidiary companies and that all of the dividends received of £14,400 were paid to Antietam Ltd by its subsidiaries?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: