Assume Ritas consulting business generated $13,000 in gross income for the current year. Further, assume Rita uses

Question:

Assume Rita’s consulting business generated $13,000 in gross income for the current year. Further, assume Rita uses the actual expense method for computing her home office expense deduction.

a. What is Rita’s home office deduction for the current year?

b. What is Rita’s AGI for the year?

c. Assume the original facts, except that Rita is an employee, and not self-employed (she uses the home office for the convenience of the employer). Consequently, she does not receive any gross income from the (sole proprietorship) business and she does not incur any business expenses unrelated to the home office. Finally, her AGI is $60,000 consisting of salary from her work as an employee. What effect do her home office expenses have on her itemized deductions?

d. Assuming the original facts, what types and amounts of expenses will she carry over to next year?

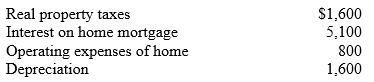

Rita owns a sole proprietorship in which she works as a management consultant. She maintains an office in her home (500 square feet) where she meets with clients, prepares bills, and performs other work-related tasks. Her business expenses, other than home office expenses, total $5,600. The following home-related expenses have been allocated to her home office under the actual expense method for calculating home office expenses.

Also, assume that not counting the sole proprietorship, Rita’s AGI is $60,000.

Step by Step Answer:

Taxation Of Individuals And Business Entities 2015

ISBN: 9780077862367

6th Edition

Authors: Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver