In August 2010, Kathy paid 60,000 to acquire 90% of the ordinary shares of an unlisted trading

Question:

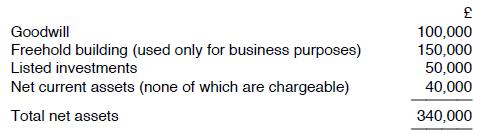

In August 2010, Kathy paid £60,000 to acquire 90% of the ordinary shares of an unlisted trading company. In May 2018, she gave all of the shares to her son and both Kathy and her son elected that the gain arising on this gift should (as far as possible) be held-over. The net assets of the company on the date of the gift (at market value) were as follows:

(a) Compute the gain arising on the gift and the amount which may be held-over.

(b) Compute the gain arising in March 2021 when Kathy's son sells all the shares for £350,000.

Transcribed Image Text:

Goodwill Freehold building (used only for business purposes) Listed investments Net current assets (none of which are chargeable) Total net assets 100,000 150,000 50,000 40,000 340,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 0% (1 review)

a Presumably the value of the shares on the date of the gift was 90 of 340000 306000 So the gain ar...View the full answer

Answered By

Mwangi Clement

I am a tried and tested custom essay writer with over five years of excellent essay writing. In my years as a custom essay writer, I have completed more than 2,000 custom essays in a diverse set of subjects. When you order essays from me, you are working with one of the best paper writers on the web. One of the most common questions I get from customers is: “can you write my essay?” Upon hearing that request, my goal is to provide the best essays and overall essay help available on the web. I have worked on papers in subjects such as Nursing and Healthcare, English Literature, Sociology, Philosophy, Psychology, Education, Religious Studies, Business, Biological Sciences, Communications and Media, Physical Sciences, Marketing and many others. In these fields, my specialties lie in crafting professional standard custom writings. These include, but are not limited to: research papers, coursework, assignments, term papers, capstone papers, reviews, summaries, critiques, proofreading and editing, and any other college essays.

My extensive custom writings experience has equipped me with a set of skills, research abilities and a broad knowledge base that allows me to navigate diverse paper requirements while keeping my promise of quality. Furthermore, I have also garnered excellent mastery of paper formatting, grammar, and other relevant elements. When a customer asks me to write their essay, I will do my best to provide the best essay writing service possible. I have satisfactorily offered my essay writing services for High School, Diploma, Bachelors, Masters and Ph.D. clients.

I believe quality, affordability, flexibility, and punctuality are the principal reasons as to why I have risen among the best writers on this platform. I deliver 100% original papers that pass all plagiarism check tests (Turnitin, Copyscape, etc.). My rates for all papers are relatively affordable to ensure my clients get quality essay writing services at reasonable prices.

4.50+

5+ Reviews

14+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

In July 2008 , Kathy paid 60,000 to acquire 90% of the ordinary shares of an unlisted trading company. In May 2015 , she gave all of the shares to her son and both Kathy and her son elected that the...

-

On 6 April 2021, Harry Johnson, aged 38, started employment with, Queens words Ltd as a proof-reader. On the 11 January 2022, Harry also entered into a partnership with his friend Debra. Together...

-

The financial statements of JJ Ltd and KK Ltd for the year to 30 June 2018 are shown below: Statements of comprehensive income for the year to 30 June 2018. Statements of financial position as at 30...

-

Prudence Corporation manufactures two products: X and Y. The company has 4,000 hours of machine time available and can sell no more than 800 units of product X. Other pertinent data follow. Which of...

-

The Mortgage Market Is Changing Fast Trump's Vow to Target China's Currency Could Be First Step to Trade War The Trump Trade Is Getting Out of Hand Does Donald Trump Spell an End to Fed's Low-Rate...

-

(LO5) In 2023, Cal, who is single, earns sole proprietor income of \(\( \$ \) 245,000\) generated from his law practice. He does not have any employees or qualified assets. Cal's modified taxable...

-

Alpha Semiconductors experienced the following activity in its Photolithography Department during December. Materials are added at the beginning of the photolithography process. Requirements: 1....

-

Curtis Rich, the cost accountant for Hi-Power Mower Company, recently installed activity-based costing at Hi-Powers St. Louis lawn tractor (riding mower) plant where three modelsthe 8-horsepower...

-

QUESTION THREE (a) (b) Joseph intends to start a small business specializing in software development to cater for the youth; however a business consultant has advised him to be extra careful before...

-

In November 2020, Leroy transfers his business to a limited company in exchange for 50,000 in cash and shares which are valued at 600,000. The gain arising on the transfer is 260,000. Leroy does not...

-

In March 2021, Jonathan gives a business asset to his daughter. Jonathan acquired the asset for 25,000 in May 2015 and its market value on the date of the gift is 60,000. Both Jonathan and his...

-

Break the class into small groups of three to five students. Have students read the discussion questions and discuss their answers within their groups. Students should be prepared to provide...

-

Consider the following airline industry data from mid-2009: a. Use the estimates in table, to estimate the debt beta for each firm (use an average if multiple ratings are listed). b. Estimate the...

-

sulphate. Calculate the molecular mass of CuSO4 5 HO hydrated copper

-

Describe SIX arguments in favour of regional integration in relation to international trade.

-

Java program 1. Prompt for a pay rate. 2. Prompt for a work hour. 3. Compute and display the salary based on the entered pay rate and work hour. 4. Prompt for a distance in miles. 5. Prompt for a...

-

Consider Richard has the following value function under prospect theory: v(w) w when w>0 =-2(-w) when w <0 Richard is deciding whether to buy a state lottery ticket. Each ticket costs $1, and the...

-

1.What is the goal of the automatic stay? 2.How did Dan Holiday Furniture violate the automatic stay provisions?

-

Consider the following cash flows in Table P5.5. (a) Calculate the payback period for each project. (b) Determine whether it is meaningful to calculate a payback period for project D. (c) Assuming...

-

A company's issued share capital consists entirely of ordinary shares, held as follows: None of the shareholders are associated in any way. (a) Is the company a close company? (b)Would the company be...

-

(a) ABC Ltd has taxable total profits of 1,800,0 00 for the year to 31 March 2018 . Taxable total profits were 1,600,000 for the year to 31 March 2017. Calculate the company's corporation tax...

-

(a) A company prepares a set of accounts for the year to 31 July 2017. When is the corporation tax liability for this period due for payment? (b)A company prepares a set of accounts for the 18 months...

-

All of the following are concerns regarding ratio analysis EXCEPT: All of the following are concerns regarding ratio analysis EXCEPT: Companies can operate in several industries making comparisons...

-

True or false controls ensure that he firm has actually completed what is set out to do in the marketing strategy that it finished implementing

-

Why is price transparency of health care costs important for consumers? a. It helps consumers understand the remittance remarks codes and payment adjustments. b. It provides increased customer...

Study smarter with the SolutionInn App