On 1 May 2006, Nigel acquired a 30-year lease for 20,000. He assigned the lease on 1

Question:

On 1 May 2006, Nigel acquired a 30-year lease for £20,000. He assigned the lease on 1 November 2020 for £75,000.

Kay purchased land in February 2012 for £20,000. She sold one-third of the land for £18,000 in March 2021 when the value of the remaining two-thirds was £60,000.

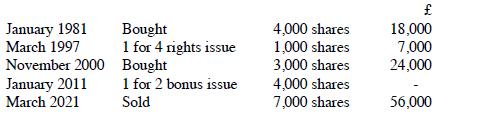

Shirley had the following dealings in the shares of Wingfield plc, a listed company:

The shares had a market value of £8 per share on 31 March 1982. No further shares were acquired during 2021.

You are required to:

(i) Calculate Nigel's chargeable gain.

(ii) Calculate Kay's chargeable gain.

(iii) Calculate Shirley's chargeable gain.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: