Sandra acquired the following ordinary shares in Pincer plc: On 26 June 2021, Sandra sold 700 of

Question:

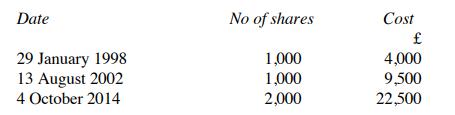

Sandra acquired the following ordinary shares in Pincer plc:

On 26 June 2021, Sandra sold 700 of her shares in Pincer plc. Assuming that she acquired no further shares in the company during 2021, calculate the chargeable gain or allowable loss if her sale proceeds in June 2021 were:

(a) £8,400

(b) £6,300

(c) £5,200.

Transcribed Image Text:

Date 29 January 1998 13 August 2002 4 October 2014 No of shares 1,000 1,000 2,000 Cost 4,000 9,500 22,500

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (1 review)

Answered By

Ashington Waweru

I am a lecturer, research writer and also a qualified financial analyst and accountant. I am qualified and articulate in many disciplines including English, Accounting, Finance, Quantitative spreadsheet analysis, Economics, and Statistics. I am an expert with sixteen years of experience in online industry-related work. I have a master's in business administration and a bachelor’s degree in education, accounting, and economics options.

I am a writer and proofreading expert with sixteen years of experience in online writing, proofreading, and text editing. I have vast knowledge and experience in writing techniques and styles such as APA, ASA, MLA, Chicago, Turabian, IEEE, and many others.

I am also an online blogger and research writer with sixteen years of writing and proofreading articles and reports. I have written many scripts and articles for blogs, and I also specialize in search engine

I have sixteen years of experience in Excel data entry, Excel data analysis, R-studio quantitative analysis, SPSS quantitative analysis, research writing, and proofreading articles and reports. I will deliver the highest quality online and offline Excel, R, SPSS, and other spreadsheet solutions within your operational deadlines. I have also compiled many original Excel quantitative and text spreadsheets which solve client’s problems in my research writing career.

I have extensive enterprise resource planning accounting, financial modeling, financial reporting, and company analysis: customer relationship management, enterprise resource planning, financial accounting projects, and corporate finance.

I am articulate in psychology, engineering, nursing, counseling, project management, accounting, finance, quantitative spreadsheet analysis, statistical and economic analysis, among many other industry fields and academic disciplines. I work to solve problems and provide accurate and credible solutions and research reports in all industries in the global economy.

I have taught and conducted masters and Ph.D. thesis research for specialists in Quantitative finance, Financial Accounting, Actuarial science, Macroeconomics, Microeconomics, Risk Management, Managerial Economics, Engineering Economics, Financial economics, Taxation and many other disciplines including water engineering, psychology, e-commerce, mechanical engineering, leadership and many others.

I have developed many courses on online websites like Teachable and Thinkific. I also developed an accounting reporting automation software project for Utafiti sacco located at ILRI Uthiru Kenya when I was working there in year 2001.

I am a mature, self-motivated worker who delivers high-quality, on-time reports which solve client’s problems accurately.

I have written many academic and professional industry research papers and tutored many clients from college to university undergraduate, master's and Ph.D. students, and corporate professionals. I anticipate your hiring me.

I know I will deliver the highest quality work you will find anywhere to award me your project work. Please note that I am looking for a long-term work relationship with you. I look forward to you delivering the best service to you.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

A measurement of the thickness of a metal plate is recorded using a metric micrometer and the reading is shown in Figure Q2. The tolerance of the measurement is 1.21 %. 0 5 10 30 25 -20 Figure Q2 a)...

-

Determine a value index for 2013 using 2000 as the baseperiod. Price Quantity Item Cabbage (pound $0.06 $0.05 2,000 1,500 Carrots (bunch) Peas (quart) Endive (bunch) 2000 2013 2000 2013 0.10 0.20...

-

Suzanne acquired the following ordinary shares in Quarine plc: She made no further acquisitions and the shares were valued at 3.20 each on 31 March 1982. On 24 July 2021, Suzanne sold 1,200 shares...

-

A dry cell battery has just been connected to a light bulb. Explain energy transfer and energy transformation in this process when the Temperature of the battery and lightbulb is increasing

-

A Nuclear Reaction Fission, the process that supplies energy in nuclear power plants, occurs when a heavy nucleus is split into two medium-sized nuclei. One such reaction occurs when a neutron...

-

A fire detection device uses 4 temperature sensors that work independently so that any one of them can activate an alarm. If the temperature reaches 200 o F, each sensor has probability 0.8 of...

-

If you were trying to examine this issue, how would you proceed? Any suggestions for me to take next steps? same. Is that what happened? You normally wouldnt borrow money from the company, would you?

-

Snookers Restaurant is open from 8:00 am to 10:00 pm daily. Besides the hours that they are open for business, workers are needed an hour before opening and an hour after closing for setup and...

-

Draw a diagram with the wage-setting relation and price-setting relation. Label your wage-setting curve WS and your price setting line PS. Label the y axis the Real Wage and the x axis the...

-

Ridge Development Group is formed on June 1st by John Parks and Sue Jones to operate as a calendar-year, accrual- basis company that develops and markets land to customers. John will contribute land...

-

Jeremy acquired the following ordinary shares in Scarlon plc: He made no further acquisitions during 2022. On 22 December 2021, he sold 10,000 shares in the company for 10 per share. Calculate the...

-

A taxpayer makes the following acquisitions of preference shares in Muvex Ltd: No further shares are acquired during 2021 or 2022. How will the following disposals be matched against these...

-

Figure 5.14 illustrates the interference experiment with Fresnel mirrors. The angle between the mirrors is a = 12', the distances from the mirrors' intersection line to the narrow slit S and the...

-

What would you add to the list of six traits that is missing? What trait is important to the way you view leadership?

-

Calculate the gravitational potential energy in the puck-Earth system during the initial snapshot. The mass of puck #1 is 5.2 g and the mass of puck #2 is 8.8 g. hint Copied to clipboard

-

6: You throw a javelin from the top of a 45m tall cliff at an angle of 36 above the horizontal and an initial velocity of 29m/s A) What is the maximum height achieved by the javelin? B) How far from...

-

What is the best answer: You decide to work for an organization because the structure is very loose, and the CEO and managers host weekly sessions to listen to the ideas of all employees. What is...

-

Discuss five areas of company performance and identify at least one financial ratio you can use to assess the company's performance in that area.

-

What are the three main activities involved in the second phase of the 3-x-3 writing process?

-

Solve each problem. Find the coordinates of the points of intersection of the line y = 2 and the circle with center at (4, 5) and radius 4.

-

Glenda has been self -employed for many years, preparing accounts to 31 March each year. Her adjusted profits (after deduction of capital allowances) are currently running at approximately 80,000 per...

-

On 1 May 2017 , a close company which prepares accounts to 31 March each year lends 30,000 to Ravi, who is one of its directors. No interest is charged on this loan. Ravi owns 18% of the company's...

-

On 19 April 2017, a c lose company (which makes up accounts to 31 March annually) lends 99,400 to Siobhan, who is a director of the company and who owns 30% of its ordinary share capital. The...

-

What are the uses of marginal costing in budgeting and forecasting? 25. Explain the concept of "marginal costing ratio" and its significance. 26. How does marginal costing help in determining the...

-

As part of Esterline part B, the Eaton Corporation has been identified as a direct competitor with the Avionics and Controls division at Esterline. For this question I want you to answer some...

-

How do functionalist analyses of social institutions, such as the family, education, and religion, emphasize their role in fostering social integration, regulating behavior, and perpetuating cultural...

Study smarter with the SolutionInn App