Tony died on 11 July 2021, leaving an estate which was valued at 900,000. None of the

Question:

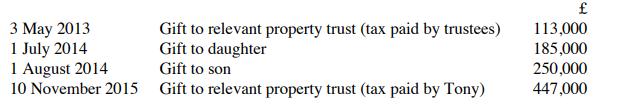

Tony died on 11 July 2021, leaving an estate which was valued at £900,000. None of the transfers made on his death were exempt from IHT. He had made the following transfers during his lifetime:

Calculate the tax payable as a result of Tony's death. (Assume that there is no unused nilrate band to be transferred from a previously deceased spouse or civil partner and that Tony's residence was not left to a direct descendant).

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: