In May 1985, InterNorth Incorporated and Houston Natural Gas announced that they would merge. Their combined value

Question:

In May 1985, InterNorth Incorporated and Houston Natural Gas announced that they would merge. Their combined value was an estimated $2.3 billion. These firms were two of the largest gas pipeline companies in the United States. As part of the negotiations, the chairman and CEO of InterNorth, Sam Segnar, would be the head of the new entity until January 1, 1987, when the chairman and CEO of Houston Natural Gas, Kenneth Lay, would take over. The new company was initially called HNG/InterNorth and later was renamed Enron. Lay’s first choice for the new name of the company was “Enteron,” but that was scrapped just days before it was announced to the public when Lay learned that enteron was the name for the digestive tract.

In 1990, Lay created a division of Enron called Enron Finance Corporation and hired Jeffrey Skilling to run the company. Skilling had been an accounting consultant to Enron through the firm of McKinsey & Company. Lay was so impressed with the accounting systems that Skilling developed for Enron that he custom-tailored the lead position at Enron Finance Corporation for him.

By 1995, Enron had become the largest independent natural gas company in the United States. In 1996, Andrew Fastow, Enron’s chief financial officer and one of the key players in Enron’s downfall, was almost fired from Enron when he did an unsatisfactory job of managing a retail unit of Enron that competed against local utilities in different parts of the United States. But Fastow used his connections within Enron to keep his job and return to the finance department.

In 1997, Skilling became president and chief operating officer of Enron. Fastow was in charge of the complex transfer of debt from Enron’s balance sheet to two LJM partnerships, which Skilling and Enron’s board of directors encouraged Fastow to form in 1999 and operate under his own name, so Enron could conduct transactions off its books and avoid reporting losses. Fastow appeared obsessed with the accumulation of wealth and considered it the only true measure of success in the business world. His obsession was ironic because Fastow’s wife, Lea, was an heiress to a real estate fortune in Houston. However, that did not dampen his desire to accumulate the $30 million he made related to the off–balance sheet partnerships and the $23 million he received for selling Enron stock in 1999 and 2000. During a congressional inquiry, Congressman James Greenwood of Pennsylvania called Fastow the “Betty Crocker of cooked books.”

Enron’s strategic focus was to convince customers and the federal government that deregulation of the energy industry would result in more choices by customers and a more competitive marketplace, and to generate the same brand recognition as AT&T. The company took a number of measures to ensure the success of this strategy, including purchasing advertising time during the Super Bowl XXXI telecast in 1997, and reinforcing Enron’s already strong personal relationship with the then governor of Texas and future president of the United States George W. Bush, whose family was a big player in the oil business.

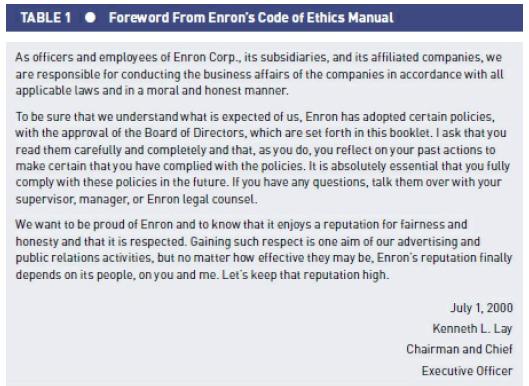

In July 2000, Enron released its code of ethics policies to its employees. The 63-page document, with two additional blank pages for notes, highlighted Enron’s ethical commitment by top management. The foreword from this document written by Lay is shown in Table 1.

In October 2000, Jordan Mintz, a lawyer, was transferred from his position as vice president for tax at Enron North America to the position of vice president and general counsel for Enron Global Finance, which was the division run by Fastow. As soon as he started reviewing the documents pertaining to the agreements between Fastow’s partnerships and Enron, Mintz was immediately troubled. He discovered that Fastow was representing his own partnership as a negotiator, and that his subordinates were representing Enron in the deals.

He also noticed that the approval sheets for deal transactions had not been signed by Skilling, even though there was a space on the documents for Skilling’s signature. When Mintz went to Richard Causey, Enron’s chief accounting officer, Causey’s advice to Mintz was not to stick his neck out to investigate the details of the transactions.7 Fastow did not sever the potential conflict-of-interest ties with the partnerships until July 2001.....

Questions

1. What are “cookie jar” reserves? Explain Enron’s use of this concept.

2. Identify as many stakeholders as you can in this case. Explain how each was affected by the events surrounding the demise of Enron.

3. Summarize the main points of this case in one succinct paragraph.

4. All the executives in this case believed they were not guilty of the charges levied against them. Why would they believe this, given the evidence presented in their trials?

Step by Step Answer:

Understanding Business Ethics

ISBN: 9781506303239

3rd Edition

Authors: Peter A. Stanwick, Sarah D. Stanwick