A. J. Smith Company started business on January 1, 2024, and the following transactions occurred in its

Question:

A. J. Smith Company started business on January 1, 2024, and the following transactions occurred in its first year:

1. On January 1, the company issued 12,000 common shares at $25 per share.

2. On January 1, the company purchased land and a building from another company in exchange for $80,000 cash and 6,000 shares. The land’s value is approximately one-quarter of the total value of the transaction.

3. On March 31, the company rented out a portion of its building to Frantek Company. Frantek is required to make quarterly payments of $7,500 on March 31, June 30, September 30, and December 31 of each year. The first payment, covering the period from April 1 to June 30, was received on March 31, and the other payments were all received as scheduled.

4. Equipment worth $120,000 was purchased on July 1, in exchange for $60,000 cash and a one-year note with a principal amount of $60,000 and an interest rate of 10%. No principal or interest payments were made during the year.

5. Inventory costing $250,000 was purchased on account.

6. Sales were $300,000, of which credit sales were $250,000.

7. The inventory sold had a cost of $190,000.

8. Payments to suppliers totalled $205,000.

9. Accounts receivable totalling $200,000 were collected.

10. Operating expenses amounted to $50,000, all of which were paid in cash.

11. The building purchased in transaction 2 is depreciated using the straight-line method, with an estimated useful life of 20 years and an estimated residual value of $30,000.

12. The equipment purchased in transaction 4 is depreciated using the straight-line method, with an estimated useful life of 10 years and an estimated residual value of $5,000. Because the equipment

was purchased on July 1, only a half year of depreciation is recognized in 2024.

13. Dividends of $20,000 were declared during the year, of which $5,000 remained unpaid at year end.

14. Interest expense on the note payable from transaction 4 was recorded.

Required

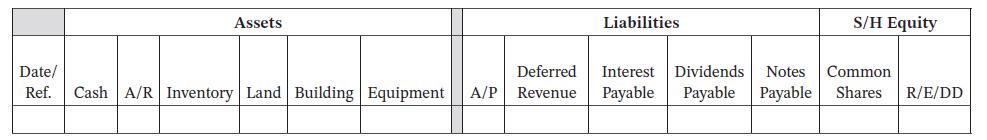

a. Show the effects of the transactions on the basic accounting equation by preparing a template like the one below.

b. Prepare a statement of income, statement of changes in equity, statement of financial position (unclassified), and statement of cash flows for 2024.

c. Comment on the company’s results for its first year of operations.

Step by Step Answer:

Understanding Financial Accounting

ISBN: 9781119715474

3rd Canadian Edition

Authors: Christopher D. Burnley