Leons Furniture Limited/Meubles Lon Lte. operates 305 stores across Canada and is the largest commercial retailer of

Question:

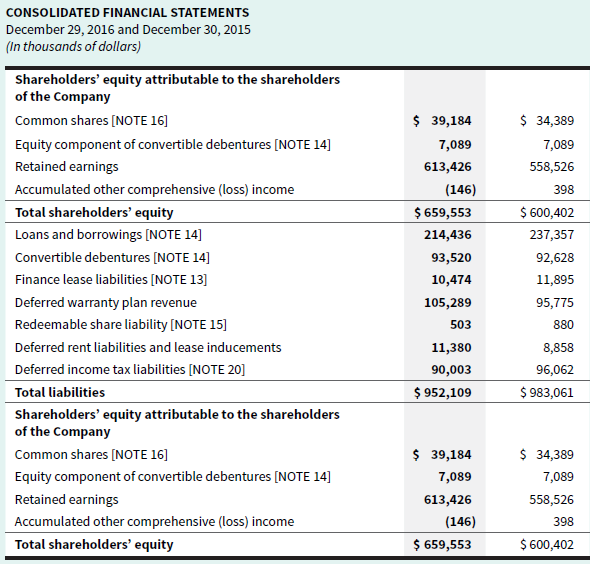

Leon’s Furniture Limited/Meubles Léon Ltée. operates 305 stores across Canada and is the largest commercial retailer of conventional and luxury appliances in Canada. Exhibits 11.12A and 11.12B present the shareholders’ equity section of the consolidated statement of financial position and excerpts from Notes 15 and 16 to Leon’s consolidated financial statements for 2016. All amounts are in thousands.

EXHIBIT 11.12A Excerpt from Leon’s Furniture Limited/Meubles Léon Ltée. 2016 Annual Report

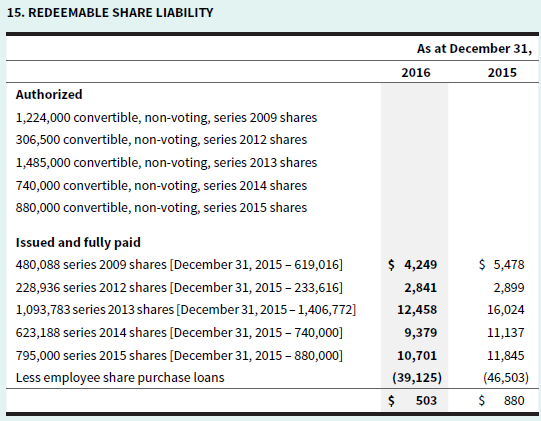

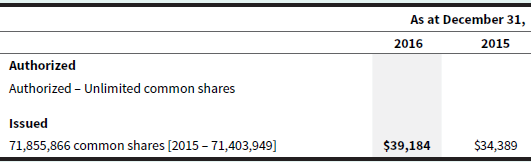

EXHIBIT 11.12B Excerpt from Notes to Leon’s Furniture Limited/Meubles Léon Ltée. 2016 Annual Report

Under the terms of the Plan, the Company advanced non-interest bearing loans to certain of its employees in 2009, 2012, 2013, 2014 and 2015 to allow them to acquire convertible, non-voting series 2009 shares, series 2012 shares, series 2013, series 2014 shares and series 2015 shares, respectively, of the Company. These loans are repayable through the application against the loans of any dividends on the shares with any remaining balance repayable on the date the shares are converted to common shares. Each issued and fully paid for series 2009 and series 2012 share may be converted into one common share at any time aft er the fifth anniversary date of the issue of these shares and prior to the tenth anniversary of such issue. Each issued and fully paid for series 2013, series 2014 and 2015 series share may be converted into one common share at any time aft er the third anniversary date of the issue of these shares and prior to the tenth anniversary of such issue. The series 2009, series 2012, series 2013, series 2014 and 2015 series shares are redeemable at the option of the holder for a period of one business day following the date of issue of such shares. The Company has the option to redeem the series 2009 and series 2012 shares at any time aft er the fifth anniversary date of the issue of these shares and must redeem them prior to the tenth anniversary of such issue. The Company has the option to redeem the series 2013, series 2014 and 2015 series shares at any time aft er the third anniversary date of the issue of these shares and must redeem them prior to the tenth anniversary of such issue. The redemption price is equal to the original issue price of the shares adjusted for subsequent subdivisions of shares plus accrued and unpaid dividends. The purchase prices of the shares are $8.85 per series 2009 share, $12.41 per series 2012 share, $11.39 per series 2013 share, $15.05 per series 2014 share and $13.46 per series 2015 share.

Dividends paid to holders of series 2009, 2012, 2013, 2014 and 2015 shares of approximately $598 [2015 – $676] have been used to reduce the respective shareholder loans. The preferred dividends are paid once a year during the first quarter. During the year ended December 31, 2016, nil series 2005 shares [2015 – 251,080], 138,928 series 2009 shares [2015 – 95,984] and 312,989 series 2013 shares [2015 – nil] were converted into common shares with a stated value of approximately $nil [2015 – $2,370], $1,229 [2015 – $850] and $3,566 [2015 – $nil], respectively.

During the year ended December 31, 2016, the Company cancelled 4,680 series 2012 shares [2015 – 14,280], 116,812 series 2014 shares [2015 – nil] and 85,000 series 2015 shares [2015 – nil] in the amount of $58 [2015 – $177], $1,758 [2015 – $nil] and $1,144 [2015 – $nil], respectively. Employee share purchase loans have been netted against the redeemable share liability, as the Company has the legally enforceable right of set-off and the positive intent to settle on a net basis.

During the year ended December 31, 2016, nil series 2005 shares [2015 – 251,080], 138,928 series 2009 shares [2015 – 95,984] and 312,989 series 2013 shares [2015 – nil] were converted into common shares with a stated value of approximately $nil [2015 – $2,370], $1,229 [2015 – $850] and $3,566 [2015 – $nil], respectively.

As at December 31, 2016, the dividends payable were $7,183 [$0.10 per share] and as at December 31, 2015 were $7,141 [$0.10 per share].

Required

a. i. How many types of shares does Leon’s have authorized?

ii. What are the main differences in the types?

iii. Why would a company have different types of shares authorized?

b. How are the preferred shares shown on the statement of financial position? Why do you believe the preferred shares are presented this way?

c. Calculate Leon’s dividend payout ratio for its common shares for 2016 and 2015. Leon’s had dividends declared per share of $0.40 in 2016 and $0.40 in 2015. The company’s earnings per share was $1.17 for 2016 and $1.08 for 2015.

DividendA dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer:

Understanding Financial Accounting

ISBN: 9781119406921

2nd Canadian Edition

Authors: Christopher D. Burnley