OCloud Corporations suite of software products and services provides secure and scalable solutions for global companies. The

Question:

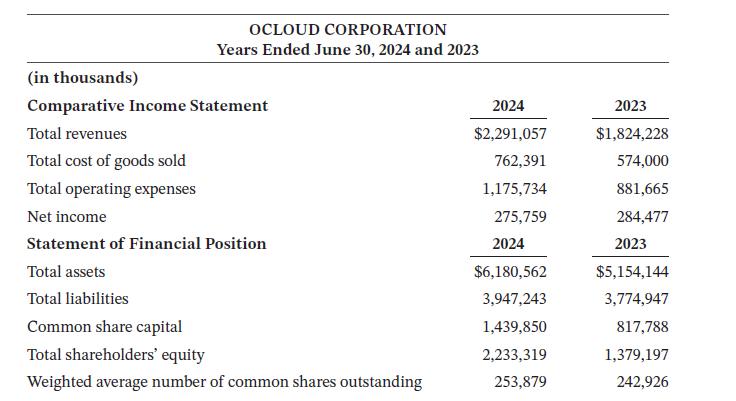

OCloud Corporation’s suite of software products and services provides secure and scalable solutions for global companies. The following is an extract from the company’s 2024 and 2023 comparative income statements and statement of financial position. The market price of OCloud’s common shares was $40.93 and $38.20 on June 30, 2024, and June 30, 2023, respectively. OCloud declared dividends per common share of $0.477 and $0.415 for 2024 and 2023, respectively.

Required

a. Calculate the return on shareholders’ equity for OCloud in 2024. Note that OCloud’s articles of incorporation authorize only common shares. The average return for the shares listed on the Toronto Stock Exchange in a comparable period was 19.8%. What information does your calculation give an investor?

b. Calculate earnings per share and the price/earnings ratio for the years 2024 and 2023. What does your calculation indicate about OCloud’s earnings?

c. Calculate the dividend payout ratio and the dividend yield for 2024 and 2023. What do the results of these ratios tell us about OCloud?

Step by Step Answer:

Understanding Financial Accounting

ISBN: 9781119715474

3rd Canadian Edition

Authors: Christopher D. Burnley