On June 30, 2024, Kovacs Company borrowed $400,000 at a bank by signing a five-year, 10% loan.

Question:

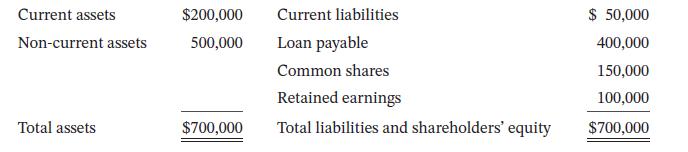

On June 30, 2024, Kovacs Company borrowed $400,000 at a bank by signing a five-year, 10% loan. The terms of the loan require equal semi-annual principal payments plus interest beginning December 31, 2024. The loan agreement requires the company to maintain a current ratio of 2.5. The December 31, 2024, year-end statement of financial position, immediately prior to the bank loan repayment and the reclassification of long-term debt, follows:

Required

a. Does Kovacs Company comply with the current ratio requirement prior to recording the December 31 loan payment?

b. Prepare journal entries to record the principal and interest payment on December 31, 2024.

c. Prepare the journal entries to reclassify the portion of the long term loan as current.

d. Does Kovacs Company comply with the current ratio requirement after preparing the journal entries above?

Step by Step Answer:

Understanding Financial Accounting

ISBN: 9781119715474

3rd Canadian Edition

Authors: Christopher D. Burnley