Organic Developments Ltd. (ODL) is an importer of organic produce from California. The company has been experiencing

Question:

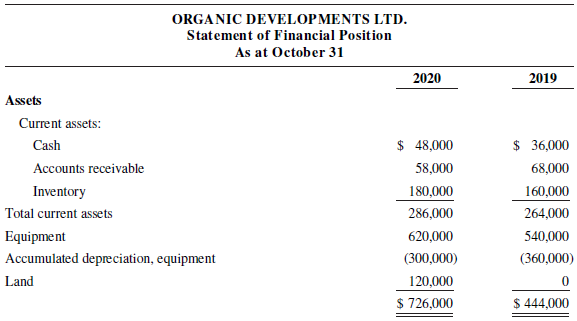

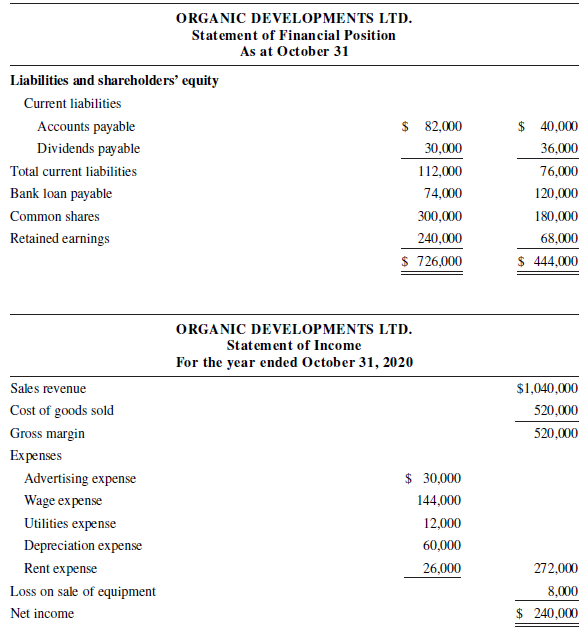

Organic Developments Ltd. (ODL) is an importer of organic produce from California. The company has been experiencing significant growth and is preparing to approach the bank for a loan to acquire additional capital assets. As CFO, you are tasked with preparing the statement of cash flows that is required as part of the loan application. You have the statement of financial position and the statement of income to help you prepare the statement of cash flows. In addition you also have the following information:

1. During the year, the company borrowed $14,000 by increasing its bank loan payable.

2. In September, ODL sold equipment for $6,000 cash. The equipment had originally cost $134,000 and had a net carrying amount of $14,000 at the time of sale.

3. In June, ODL acquired land with a value of $120,000 by issuing common shares with an equivalent value. The land is to be used as a site for a warehouse it hopes to construct in the next year.

Required

a. Using the information above, prepare the statement of cash flows for Organic Developments Ltd. for the year ended October 31, 2020, using the indirect method.

b. Determine the cash flows from operating activities using the direct method.

Step by Step Answer:

Understanding Financial Accounting

ISBN: 9781119406921

2nd Canadian Edition

Authors: Christopher D. Burnley