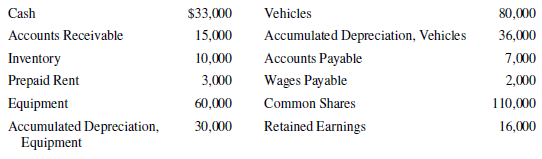

Perfect Pizza had the following account balances at December 31, 2019: During 2020, the following transactions occurred:

Question:

Perfect Pizza had the following account balances at December 31, 2019:

During 2020, the following transactions occurred:

1. Purchases of ingredients and supplies (inventory) were $230,000, all on account.

2. Sales of pizzas for cash were $510,000, and sales of pizzas on account were $40,000.

3. The company paid $105,000 for wages.

4. The company also paid $25,000 for utilities expenses.

5. Payments for ingredients and supplies purchased on account totalled $220,000.

6. Collections from customers for sales on account totalled $38,000.

7. Ingredients and supplies valued at $225,000 were used in making pizzas that were sold.

8. A dividend of $15,000 was declared and paid at the end of the year.

Information for adjusting entries:

9. At the end of 2020, the amount of rent paid in advance was $1,500.

10. Wages owed to employees at the end of 2020 were $2,500.

11. The equipment had an estimated useful life of eight years, with no residual value.

12. The delivery vehicles had an estimated useful life of six years with a residual value of $8,000.

Required

a. Prepare journal entries for transactions 1 through 8. Create new accounts as necessary.

b. Prepare adjusting journal entries for adjustments 9 to 12.

c. Set up T accounts, enter the beginning balances from 2019, post the 2020 entries, and calculate the balance in each account.

d. Prepare a trial balance, and ensure that the total of the debit balances is equal to the total of the credit balances.

e. Prepare a statement of income for 2020.

f. Prepare the closing entries, post them to the T accounts, and calculate the final balance in each account.

g. Prepare a statement of financial position for 2020.

DividendA dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer:

Understanding Financial Accounting

ISBN: 9781119406921

2nd Canadian Edition

Authors: Christopher D. Burnley