Select a publicly traded company for analysis. Using the firms most recent 10-K Report (accessed through the

Question:

Select a publicly traded company for analysis. Using the firm’s most recent 10-K Report (accessed through the SEC EDGAR database at sec.gov or from the company’s website), identify how financial data in the reported financial statements and nonfinancial metrics from the Management Discussion and Analysis section are linked to your overall assessment of the firm’s financial condition and performance. Use and interpret the information to make an informed evaluation of the firm’s outlook.

Sample Analysis from the 10-K Report of Eastman Kodak Company15 For the Year Ended December 31, 2021 In the MD&A section of the 2021 10-K report for Eastman Kodak Company, management focuses on improvements in revenues and profits for 2021, resulting from the ongoing diversification of the company. According to management, continuing this positive trend in financial performance will depend on the company’s ability to improve and sustain its operating structure, cash flow, profitability, and other financial results.

Management states in the Liquidity and Capital Resources section that an increase in the cash balance, ending 2021 with an increase of \($166\) million from year-end 2020, together with financing transactions will provide the additional liquidity needed to fund ongoing operations and obligations as well as to invest in growth opportunities.

The company plans include returning to sustainable positive cash flow, reducing operating expenses, simplifying the organizational structure, and generating cash from selling and leasing underutilized assets. Expected cash from operations, together with borrowing, will be sufficient to meet the company’s short-term and long-term cash requirements.

This 140-page 10-K report for 2021 has an almost overwhelming volume of information, in both written and numerical formats. Identifying links between financial and nonfinancial metrics to assess the firm’s financial condition, performance, and outlook requires a focus on items from the financial statements that are relevant to what management chooses to discuss in the MD&A section. In the 2021 report, management has emphasized the importance of changes in revenues, net income, and cash flow, so the analysis should include consideration of these items from the financial statements.

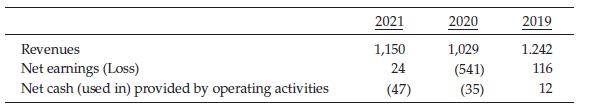

For the years ended 2021, 2020, and 2019, revenues, net earnings, and cash flow from operations are reported as follows (in millions of dollars) in the Eastman Kodak Company financial statements:

Eastman Kodak improved both profitability and revenue in 2021, net income relatively more than revenue, reflecting the overall positive management of the company’s operations. But both are below the pre-pandemic levels achieved in 2019. The company failed to generate cash flow from operations in either 2021 or 2020. That means more borrowing has been needed.

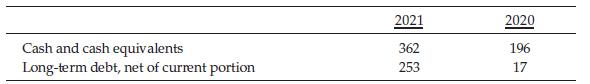

From the Eastman Kodak Company Consolidated Statement of Financial Position (in millions of dollars):

Although management chooses to tout an increase in the cash account from \($196\) million to \($362\) million, the balance sheet also reveals an increase in long-term debt from 17 million to 253 million, which confirms that the cash bump comes from borrowing, not from operations.

The discussions of credit availability in the MD&A section and in the Notes to the Financial Statements suggest an ongoing availability of financing as needed. But management confirms in the MD&A that it is imperative for the company to generate operating cash flow to ensure future success.

Management’s perspective, as expected, is positive as to the direction the company is taking, with caveats concerning certain operational and financial objectives that need to be met. The financial statements, however, reveal ongoing problems and questions. The helpful next step would be an in-depth analysis of the cash flow statement (covered in Chapter 4) to determine why the company is not able to translate net income into cash flow from operations. That could be the result, for example, of identifying specific problems such as a buildup of unsellable inventory.

In evaluating the company’s overall condition, performance, and outlook, it is important to recognize in Eastman Kodak’s 10-K report that the nonfinancial metrics, such as management’s expectations, in some ways contradict what is revealed in the financial data about the company’s capabilities. This seeming contradiction is not surprising or unusual. Management would be expected to put the company’s best foot forward, while the financial statements ground the analysis in reality. The financial statements are always central to any analysis.

The company has demonstrated some improvement in financial performance, a trend management expects will continue, but the outlook is mixed. The stated objectives will only succeed if certain problems are effectively addressed, including not having to overload debt in order to maintain liquidity until a turnaround in cash flow from operations can be achieved.

Step by Step Answer:

Understanding Financial Statements

ISBN: 9780138114404

12th Edition

Authors: Lyn Fraser, Aileen Ormiston