Select two competing companies from the same industry, for example, Coke and Pepsi, Adidas and Nike, Verizon

Question:

Select two competing companies from the same industry, for example, Coke and Pepsi, Adidas and Nike, Verizon and AT&T, Intel and Samsung, General Motors and Ford, Costco and Kroger. Using selected financial statement information (net sales, cost of goods sold, gross profit, net income, accounts receivable, inventories, and total assets),

1. Describe the operations of the two companies, and compare the firms in terms of size as measured by net sales and total assets.

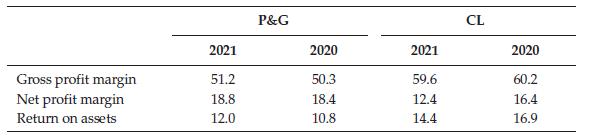

2. Analyze and compare profitability for the two firms using relevant financial ratios—gross profit margin (gross profit/sales), net profit margin (net income/sales), and return on assets (net income/total assets). Identify and find information needed from notes to the financial statements to address questions or missing information.

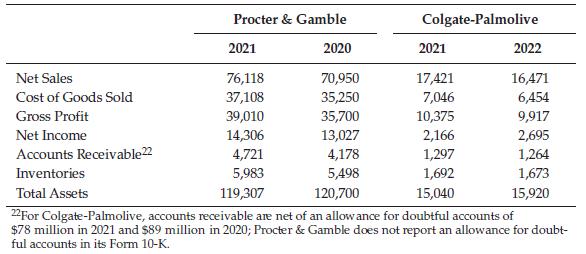

Sample analysis from the 10-K Reports of Procter & Gamble Company (P&G)and Colgate-Palmolive Company (CL) in millions of dollars for 2021 and 2020.

Procter & Gamble (P&G) and Colgate-Palmolive (CL) are major companies in the consumer goods industry. P&G operates in five segments—beauty, grooming, health care, fabric and home care, and baby/feminine/family care. The company sells products through mass merchandisers, e-commerce, grocery stores, membership clubs, drug stores, and department stores. CL has two product segments: (1) oral, personal, household surface, and fabric care; and (2) pet nutrition. CL markets its products through retailers, wholesalers, e-commerce, and distributers. During the period of analysis, both firms are dealing with the COVID-19 pandemic, recovery from the pandemic, increasing inflation, and supply chain issues. A relatively inelastic demand for the types of many of the consumer goods marketed by these companies, however, has helped sustain sales for the industry in general.

Using the metrics of net sales and total assets, P&G is the significantly larger company. P&G also appears stronger in the level and growth of net income, especially as CL experienced a decline in net income during 2021. But financial ratios, which facilitate the comparison of different sized firms, provide a somewhat different perspective on the two firms’ profitability.

CL’s gross profit margin is significantly higher than P&G’s, a key positive indicator for the company’s management of operations. Although the CL net profit margin is weaker than P&G’s, the overall return on assets—income generation relative to the firm’s total investment in assets—is another strength for CL, even with the decline in net income during 2021. What that suggests is that CL is able to earn a higher return relative to its total investment in assets. In comparison, however, P&G has shown consistent improvement in all three profit measures—gross profit margin, net profit margin, and return on assets. Given this mix, it would appear that neither company has demonstrated a consistent, significant edge in profitability.

A piece of missing information for P&G, however, is the allowance for doubtful accounts. The balance sheet for P&G shows no allowance account. With annual sales of well over $70 billion and accounts receivable of almost $5 billion, this is puzzling.

The P&G 10-K includes no discussion of an allowance account, suggesting that management considers the amount of potential bad debt expense “immaterial.” But the P&G 10-K report does include a seemingly contradictory statement that “companies may suffer financial hardships due to economic conditions such that their accounts become uncollectible or are subject to longer collection cycles,” acknowledging the potential for significant bad debts in the future.

Notes to the financial statements reveal that both companies use the FIFO method of inventory accounting, P&G for all of its inventories and CL for 75% of its inventories. The FIFO choice means that during a period of inflation, such as the current situation, both companies benefit from lower cost of goods sold and higher income, relatively more so for P&G than CL; and inventory on the balance sheet reflects the value of higher-price goods most recently purchased. During a period of inflation, LIFO produces higher-quality earnings because it matches current costs with current revenues. The FIFO choice results in lower-quality earnings, as does P&G’s not having an allowance account or any explanation of why.

Step by Step Answer:

Understanding Financial Statements

ISBN: 9780138114404

12th Edition

Authors: Lyn Fraser, Aileen Ormiston