Spin Master Corp. is a Toronto-based company that designs, markets, and sells entertainment products for children. Exhibit

Question:

Spin Master Corp. is a Toronto-based company that designs, markets, and sells entertainment products for children. Exhibit 8.27 is an extract from Spin Master’s consolidated financial statements for its year ended December 31, 2016.

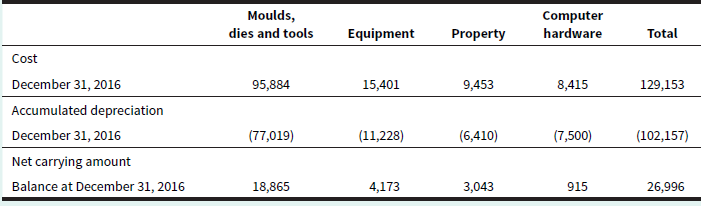

EXHIBIT 8.27 Extract from Spin Master Corp. 2016 Consolidated Financial Statements (in thousands of US dollars)

Spin Master’s depreciation policies for its property and equipment state that: Depreciation is recognized so as to write off the cost or valuation of assets less their residual values over their useful lives, using the straight-line method or declining balance method. The estimated useful lives, residual values and depreciation method are reviewed at the end of each reporting period, with the effect of any changes in estimate accounted for on a prospective basis. The following are the estimated useful lives for the major classes of property, plant and equipment:

Land .......................................................................................................... Not depreciated

Buildings ................................................................................................... 30 years

Moulds, dies and tools ........................................................................... 2 years

Off ice equipment ................................................................................... 3 years

Leasehold improvements Lesser of lease term or ............................. 5 years

Computer hardware ............................................................................... 3 years

Machinery and equipment .................................................................... 30% declining balance

Required

a. Determine the average age percentage of Spin Master’s moulds, dies, and tools. Does this make sense given the company’s depreciation estimates for them?

b. Spin Master recorded depreciation on its computer hardware in the amount of $446 thousand for its 2016 fiscal year. Compare the estimated useful life for computer hardware used by Spin Master with that used by Dollarama (see Appendix A). Explain what might be the reason for the difference.

c. What is management saying about the expected useful life of its machinery and equipment, given the depreciation method used for them?

d. The net carrying amount of Spin Master’s property, plant, and equipment at December 31, 2015, was $16,096 thousand. If Spin Master’s sales revenue was $1,154,454 thousand for the 2016 fiscal year, determine the company’s fixed asset turnover ratio. Explain what you can tell about Spin Master based on the result of this ratio.

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Asset Turnover

Asset turnover is sales divided by total assets. Important for comparison over time and to other companies of the same industry. This is a standard business ratio.

Step by Step Answer:

Understanding Financial Accounting

ISBN: 9781119406921

2nd Canadian Edition

Authors: Christopher D. Burnley