The Pine Boutique Ltd. operates several stores selling pine furniture. Selected financial ratios are as follows: In

Question:

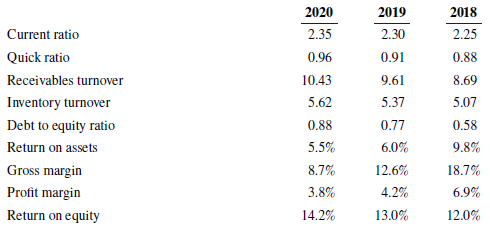

The Pine Boutique Ltd. operates several stores selling pine furniture. Selected financial ratios are as follows:

In 2018, Pine Boutique decided to change its strategy from selling high-end furniture to selling lower-cost items in order to be more competitive and began importing low-cost furniture. In order to do this the company invested in new warehouse facilities and its total assets grew from $2.5 million in 2018 to $4.5 million in 2019 and finally to $5 million in 2020.

Required

a. Briefly discuss what these financial ratios indicate about how Pine Boutique was affected by its decision to change its strategy in 2018.

b. Which measures have deteriorated during the subsequent periods?

c. Which ratios indicate positive action taken by Pine Boutique during the subsequent periods?

Financial RatiosThe term is enough to curl one's hair, conjuring up those complex problems we encountered in high school math that left many of us babbling and frustrated. But when it comes to investing, that need not be the case. In fact, there are ratios that,...

Step by Step Answer:

Understanding Financial Accounting

ISBN: 9781119406921

2nd Canadian Edition

Authors: Christopher D. Burnley