Let (T_{0}=0, T_{1}, T_{2}, ldots) denote dates where (T_{n}) is (n) days from today (left(T_{0}ight)). An asset's

Question:

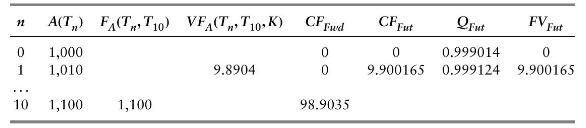

Let \(T_{0}=0, T_{1}, T_{2}, \ldots\) denote dates where \(T_{n}\) is \(n\) days from today \(\left(T_{0}ight)\). An asset's price is \(\$ 1,000\) today, \(A\left(T_{0}ight)=1000\), and the continuously compounded interest rate is constant, \(r=4 \%\) with fractions of time calculated Act/365: \(T_{i+1}-T_{i}=1 / 365\).

(a) What is the 10-day forward price of the asset, \(F_{A}\left(0, T_{10}ight)\) ?

(b) You agree today \(\left(T_{0}=0ight)\) to buy the asset in 10 days for \(K=F_{A}\left(0, T_{10}ight)\). How much do you need to pay/receive today to enter into this contract?

(c) Assume the asset's price increases by \(\$ 10\) each day for the next 10 days, \(A\left(T_{n}ight)=A(0)+10 n\), and compute the missing entries in the following table where \(C_{F u t}\) is the cash flow for one futures contract, \(C F_{F w d}\) is the cash flow for one forward contract, \(Q_{\text {Fut }}\) is the number of futures contracts needed to replicate one forward contract, and \(F V_{\text {Fut }}=F V(Q \times C F)\) is the corresponding cash flow of the modified futures contract, future valued to \(T_{10}\).

(d) Compare the total cash flows of one (unmodified) futures contract versus the forward contract.

(e) Would \(Q_{\text {Fut }}\) be different if the underlying had instead dropped by \(\$ 10\) each day to settle at \(\$ 900\) at \(T_{10}\) ?

Step by Step Answer:

Mathematical Techniques In Finance An Introduction Wiley Finance

ISBN: 9781119838401

1st Edition

Authors: Amir Sadr