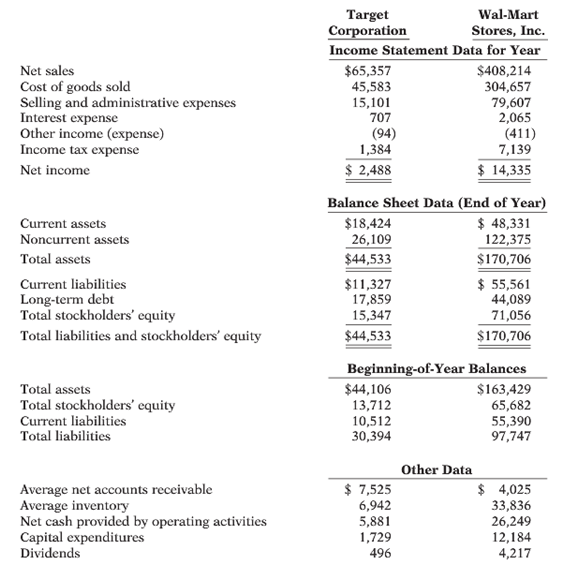

Suppose selected financial data of Target and Wal-Mart for 2014 are presented here (in millions). Instructions (a)

Question:

Suppose selected financial data of Target and Wal-Mart for 2014 are presented here (in millions).

Instructions

(a) For each company, compute the following ratios.

(1) Current ratio.

(2) Accounts receivable turnover.

(3) Average collection period.

(4) Inventory turnover.

(5) Days in inventory.

(6) Profit margin.

(7) Asset turnover.

(8) Return on assets.

(9) Return on common stockholders’ equity.

(10) Debt to assets ratio.

(11) Times interest earned.

(12) Current cash debt coverage.

(13) Cash debt coverage.

(14) Free cash flow.

(b) Compare the liquidity, solvency, and profitability of the two companies.

Transcribed Image Text:

Target Corporation Income Statement Data for Year Wal-Mart Stores, Inc. $65,357 45,583 15,101 707 Net sales $408,214 304,657 79,607 2,065 (411) 7,139 Cost of goods sold Selling and administrative expenses Interest expense Other income (expense) Income tax expense (94) 1,384 $ 2,488 $ 14,335 Net income Balance Sheet Data (End of Year) $ 48,331 122,375 $170,706 Current assets $18,424 26,109 $44,533 Noncurrent assets Total assets $ 55,561 44,089 71,056 Current liabilities Long-term debt Total stockholders' equity $11,327 17,859 15,347 Total liabilities and stockholders' equity $44,533 $170,706 Beginning-of-Year Balances Total assets Total stockholders' equity Current liabilities Total liabilities $44,106 13,712 10,512 30,394 $163,429 65,682 55,390 97,747 Other Data $ 7,525 6,942 5,881 1,729 496 $ 4,025 33,836 26,249 12,184 4,217 Average net accounts receivable Average inventory Net cash provided by operating activities Capital expenditures Dividends

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (15 reviews)

a Ratio Target WalMart All Dollars Are in Millions 1 Current ratio 2 Accounts receivable turnover 3 ...View the full answer

Answered By

Nyron Beeput

I am an active educator and professional tutor with substantial experience in Biology and General Science. The past two years I have been tutoring online intensively with high school and college students. I have been teaching for four years and this experience has helped me to hone skills such as patience, dedication and flexibility. I work at the pace of my students and ensure that they understand.

My method of using real life examples that my students can relate to has helped them grasp concepts more readily. I also help students learn how to apply their knowledge and they appreciate that very much.

4.00+

1+ Reviews

10+ Question Solved

Related Book For

Accounting Tools for Business Decision Making

ISBN: 978-1118128169

5th edition

Authors: Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso

Question Posted:

Students also viewed these Managerial Accounting questions

-

3. Under a special annuity, there are payments at times t = 1,2,3..... 30 (in years). The amount of the payment at time t is the minimum of $10,000(1.05) and $25,000. Find the present value of this...

-

Selected financial data of Target and Wal-Mart for 2009 are presented here (in millions). Instructions(a) For each company, compute the following ratios.(1) Current. (2) Receivables turnover. (3)...

-

Selected financial data of Target (USA) and Wal-Mart Stores, Inc. (USA) for a recent year are presented below (in millions). Instructions (a) For each company, compute the following ratios. (1)...

-

Scott incorporates his sole proprietorship as Superior Corporation and transfers its assets to Superior in exchange for all 100 shares of Superior stock and four $7,500 interest-bearing notes. The...

-

In Exercise, find the standard matrix of the given linear transformation from R2 o R2. a. Counterclockwise rotation through 120o about the origin b. Clockwise rotation through 30o about origin c....

-

Dandino Ltd was formed on 1 March 2020 for the purpose of purchasing the business of Verama Ltd whose assets and liabilities at that date were as shown below. Additional information 1. Dandino Ltd...

-

A parallel-plate capacitor has plates of area \(A\). The plates are initially separated by a distance \(d\), but this distance can be varied. If the capacitor is charged by a battery and the battery...

-

Maxwell Company manufactures and sells a single product. The following costs were incurred during the companys first year of operations: VARIABLE COSTS PER UNIT: Manufacturing: Direct materials. . ....

-

14.An equi-concave lens of radius of curvature 15 cm and = 1.5 is placed in water (=1.33). If one surface is silvered, then image distance from lens when an object is placed at distance of 14 cm from...

-

1. Use the numbers given to complete the cash budget and short-term financial plan. 2. Rework the cash budget and short-term financial plan assuming Piepkorn changes to a minimum balance of $100,000....

-

The following financial information is for Frizell Company. Additional information: 1. Inventory at the beginning of 2013 was $115,000. 2. Accounts receivable (net) at the beginning of 2013 were...

-

Here are comparative statement data for Dean Company and Gerald Company, two competitors. All balance sheet data are as of December 31, 2014, and December 31, 2013. Instructions (a) Prepare a...

-

Pyridine (C5H5N) acts as a Brnsted-Lowry base in water. Write the hydrolysis reaction for pyridine and identify the Brnsted-Lowry acid and Brnsted-Lowry base.

-

In light of new tax incentives, a tech company incorporates in a different state and moves their headquarters. What type of organizational change does this represent?

-

The pouring of a foundation for a new building took three days longer than planned. What type of project change would this represent?

-

DewDrops is wondering about the timeliness of their checkout process. Danielle has been tasked with creating a tool to track and display this observed data. What output should she create?

-

Gus is working in an oilfield assigned to a project in a remote area. The trailer he works out of has a telephone line, but Internet connectivity and mobile phone coverage is spotty. What would be...

-

Please discuss when starting up a new product/service such as a reusable/ insulated food delivery box that will allow a variety of customers to order food from a location such as Starbucks while...

-

Find formulas for the functions represented by the integrals. J2 dt 12

-

A circular concrete shaft liner with Youngs modulus of 3.4 million psi, Poissons ratio of 0.25, unconfined compressive strength 3,500 psi and tensile strength 350 psi is loaded to the verge of...

-

Which of the following statements is correct? (a) Customers have a right of access to the day-to-day accounting records of limited companies. (b) Directors have a right of access to the day-to-day...

-

What are the guidelines that a company should consider when choosing among the three methods of determining cost for inventories: specific identification, FIFO, and average cost?

-

Which inventory cost method-FIFO or average cost-provides the better measure of cost of goods sold on the income statement? The better measure of ending inventory on the statement of financial...

-

Helgeson Inc. identifies the following items as possibly belonging in its physical inventory count. For each item, indicate whether or not it should be included in the inventory. (a) Goods shipped on...

-

You are working in an automotive workshop. Three (3) clients have brought in three (3) different vehicles that require diagnosis and repairs to the suspension systems and components. Your task is to...

-

5. Part 2: Torsion testing The aim of the torsion test is to find the shear modulus, yield and ultimate shear strength for the specimen material. Use the supplied dataset that matches with the LAST...

-

4. Part 1: Tensile testing The aim of the tensile test is to find the yield and ultimate tensile strengths and corresponding normal strains of the test material. This enables the prediction of the...

Study smarter with the SolutionInn App