Suppose that in July 2009, Google were to issue $96 billion in zero-coupon senior debt, and another

Question:

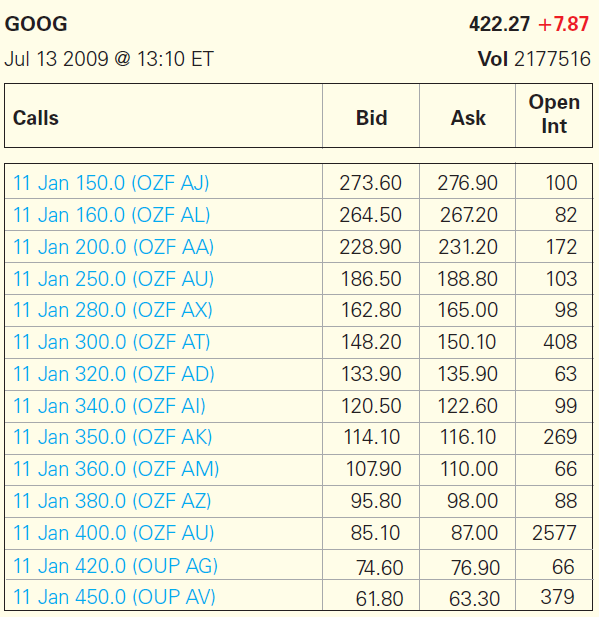

Suppose that in July 2009, Google were to issue $96 billion in zero-coupon senior debt, and another $32 billion in zero-coupon junior debt, both due in January 2011. Use the option data in the preceding table to determine the rate Google would pay on the junior debt issue. (Assume perfect capital markets.)

Transcribed Image Text:

GOOG 422.27 +7.87 Jul 13 2009 @ 13:10 ET Vol 2177516 Open Int Calls Bid Ask 11 Jan 150.0 (OZF AJ) 273.60 276.90 100 11 Jan 160.0 (OZF AL) 264.50 267.20 82 11 Jan 200.0 (OZF AA) 231.20 228.90 172 11 Jan 250.0 (OZF AU) 186.50 188.80 103 11 Jan 280.0 (OZF AX) 162.80 165.00 98 150.10 11 Jan 300.0 (OZF AT) 148.20 408 11 Jan 320.0 (OZF AD) 133.90 135.90 63 11 Jan 340.0 (OZF AI) 120.50 122.60 99 11 Jan 350.0 (OZF AK) 114.10 116.10 269 11 Jan 360.0 (OZF AM) 107.90 110.00 66 11 Jan 380.0 (OZF AZ) 88 95.80 98.00 87.00 11 Jan 400.0 (OZF AU) 85.10 2577 11 Jan 420.0 (OUP AG) 66 74.60 76.90 11 Jan 450.0 (OUP AV) 379 61.80 63.30

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 40% (10 reviews)

The debt value is 874 billion and the rate is 646 Next we can determine the value of equity Because ...View the full answer

Answered By

ALBANUS MUTUKU

If you are looking for exceptional academic and non-academic work feel free to consider my expertise and you will not regret. I have enough experience working in the freelancing industry hence the unmistakable quality service delivery

4.70+

178+ Reviews

335+ Question Solved

Related Book For

Question Posted:

Students also viewed these Corporate Finance questions

-

Suppose that in July 2013, Nike had EPS of $2.52 and a book value of equity of $12.48 per share. a. Using the average P/E multiple in Table 7.2 , estimate Nikes share price. b. What range of share...

-

Suppose that in July 2013, Nike had EPS of $2.52 and a book value of equity of $12.48 per share. a. Using the average P/E multiple in Table 10.1, estimate Nike's share price. b. What range of share...

-

Suppose that in July 2013, Nike had sales of $25,313 million, EBITDA of $3,254 million, excess cash of $3,337 million, $1,390 million of debt, and 893.6 million shares outstanding. a. Using the...

-

Within the context of the planning cycle, the planning that takes place at the highest levels of the firm is called: A. detailed planning and control. B. strategic planning. C. operational planning....

-

"Moonlighters" are workers who hold two jobs at the same time. What are the factors that impact the likelihood of a moonlighting worker becoming aggressive toward his/her supervisor? This was the...

-

What is organizational communication with employees like in the 24/7 work environment? How has technology changed the ways managers communicate with employees and vice versa?

-

Evaluate machine XYZ on the basis of the PW method when the MARR is $12 \%$ per year. Pertinent cost data are as follows: Investment cost Useful life Market value Annual operating cost Overhaul cost...

-

Fore Farms reported a pretax operating loss of $137 million for financial reporting purposes in 2021. Contributing to the loss were (a) a penalty of $5 million assessed by the Environmental...

-

Assume that CEDE Insurance Company has purchased from SS Reinsurance Company a surplus share treaty with a $5,000,000 limit and a retention of $70,000. CEDE has written three policies. Policy A...

-

PHB Company currently sells for $ 32.50 per share. In an attempt to determine whether PHB is fairly priced, an analyst has assembled the following information: The before - tax required rates of...

-

Use the option data from July 13, 2009 in the following table to determine the rate Google would have paid if it had issued $128 billion in zero-coupon debt due in January 2011. Suppose Google...

-

The current price of Estelle Corporation stock is $25. In each of the next two years, this stock price will either go up by 20% or go down by 20%. The stock pays no dividends. The one-year risk-free...

-

Simplify. Assume that x 0. 10 x16

-

The Type A behavior pattern is known to directly cause heart attacks. True or false?

-

For each of the following accounts, indicate which has a normal debit balance and which has a normal credit balance. 1. Retained earnings 2. Machinery 3. Depreciation 4. Dividends 5. Revenue 6....

-

During a routine check on the accounts of Dar Al Fatina, the following errors were identified. You are required to state which of these errors causes an unequal total in the trial balance and which...

-

The county fair reported the following total attendance (in thousands). Find the mean, median, and mode for the attendance figures (rounded to the nearest thousand). Year Attendance 2012 2011 2010...

-

During the month of June, the following transactions took place at the Islamic Finance Training Company. Prepare the journal entry for each of these transactions. a. Received 75,000 from owner. b....

-

Provide an example of a knowledge problem that has impacted a company or an organization. Describe how setting up an internal market would help better allocate resources to solve the knowledge...

-

The following exercises are not grouped by type. Solve each equation. x610x -9

-

What controls can you identify in the management of your school or at a company where you have worked? How might the organizations performance change if those controls were not in place?

-

How can a hostile acquirer get around a poison pill?

-

What mechanisms allow corporate raiders to get around the free rider problem in takeovers?

-

Based on the empirical evidence, who gets the value added from a takeover? What is the most likely explanation of this fact?

-

You placed $6,599 in a savings account today that earns an annual interest rate of 3 percent compounded annually. How much you will have in this account at the end of 2 years?

-

You're planning a trip to France. The current exchange rate is 1.21 dollars per euro. If you want to get 3,000, how many dollars do you have to pay? If you want to exchange $3,000, how many euros...

-

The exchange rate between euros and dollars is currently 0.83 euros per dollar. Inflation is expected to be 1% in Europe and 2% in the US. If relative purchasing power parity holds, what is the...

Study smarter with the SolutionInn App