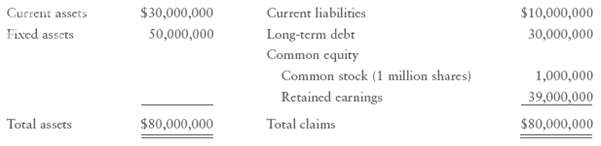

Suppose the School Company has this book value balance sheet: The current liabilities consist entirely of notes

Question:

Suppose the School Company has this book value balance sheet:

The current liabilities consist entirely of notes payable to banks, and the interest rate on this debt is 10 percent, the same as the rate on new bank loans. The long-term debt consists of 30,000 bonds, each of which has a par vale of $1,000, carries an annual coupon interest rate of 6 percent, and matures in 20 years. The going rate of interest on new long-term debt, rd, is 10 percent, and this is the present yield to maturity on the bonds. The common stock sells at a price of $60 per share. Calculate the firm's market value capital structure.

Common StockCommon stock is an equity component that represents the worth of stock owned by the shareholders of the company. The common stock represents the par value of the shares outstanding at a balance sheet date. Public companies can trade their stocks on... Coupon

A coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity. Coupons are usually referred to in terms of the coupon rate (the sum of coupons paid in a... Maturity

Maturity is the date on which the life of a transaction or financial instrument ends, after which it must either be renewed, or it will cease to exist. The term is commonly used for deposits, foreign exchange spot, and forward transactions, interest...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial management theory and practice

ISBN: 978-0324422696

12th Edition

Authors: Eugene F. Brigham and Michael C. Ehrhardt

Question Posted: