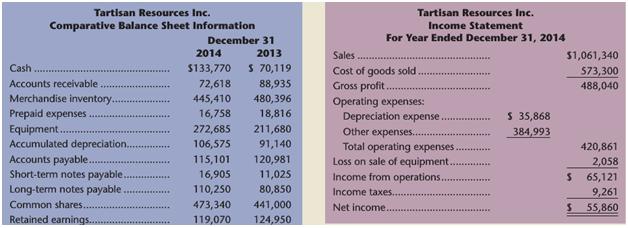

Tartisan Resources Inc., a sporting goods retailer, recently completed its 2014 operations. Tartisan Resources Inc.s balance sheet

Question:

Tartisan Resources Inc., a sporting goods retailer, recently completed its 2014 operations. Tartisan Resources Inc.’s balance sheet information and income statement follow.

Additional information regarding Tartisan’s activities during 2014:

1. Loss on sale of equipment is $2,058.

2. Equipment costing $49,980 is sold for $27,489.

3. Equipment is purchased by paying cash of $37,485 and signing a long-term note payable for the balance.

4. Borrowed $5,880 by signing a short-term note payable.

5. Reduced a long-term note payable by making a payment.

6. Issued 2,940 common shares for cash at $11 per share.

7. Declared and paid cash dividends.

Required

Prepare a statement of cash flows for 2014 that reports the cash inflows and outflows from operating activities according to the indirect method. Show your supporting calculations. Also prepare a note describing non-cash investing and financing activities.

Analysis Component: Using the information from the statement of cash flows just prepared for Tartisan Resources Inc., identify the accrual basis net income and the cash basis net income for 2014. Explain why there is a difference between the twoamounts.

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

Fundamental Accounting Principles Volume II

ISBN: 978-1259066511

14th Canadian Edition

Authors: Larson Kermit, Jensen Tilly