Go back

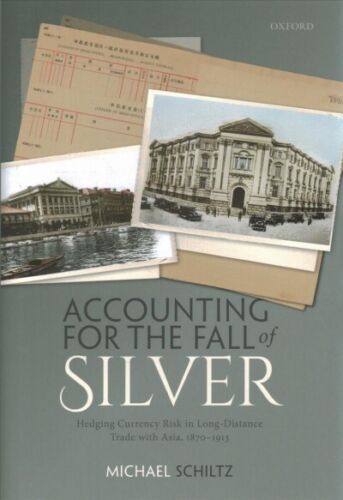

Accounting For The Fall Of Silver Hedging Currency Risk In Long Distance Trade With Asia 1870-1913(1st Edition)

Authors:

Michael Schiltz

Cover Type:Hardcover

Condition:Used

In Stock

Include with your book

Free shipping: April 30, 2024Popular items with books

Access to 3 Million+ solutions

Free ✝

Ask 10 Questions from expert

200,000+ Expert answers

✝ 7 days-trial

Total Price:

$0

List Price: $93.46

Savings: $93.46(100%)

Book details

ISBN: 9780198865025, 0198865023

Book publisher: Oxford University Press, Incorporated

Get your hands on the best-selling book Accounting For The Fall Of Silver Hedging Currency Risk In Long Distance Trade With Asia 1870-1913 1st Edition for free. Feed your curiosity and let your imagination soar with the best stories coming out to you without hefty price tags. Browse SolutionInn to discover a treasure trove of fiction and non-fiction books where every page leads the reader to an undiscovered world. Start your literary adventure right away and also enjoy free shipping of these complimentary books to your door.