Go back

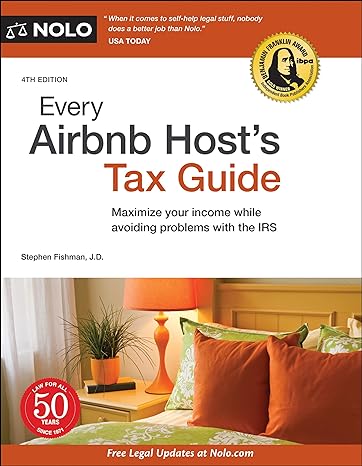

Every Airbnb Hosts Tax Guide Maximize Your Income While Avoiding Problems With The IRS(4th Edition)

Authors:

Stephen Fishman J.D.

Cover Type:Hardcover

Condition:Used

In Stock

Include with your book

Free shipping: April 04, 2024Popular items with books

Access to 3 Million+ solutions

Free ✝

Ask 10 Questions from expert

200,000+ Expert answers

✝ 7 days-trial

Total Price:

$0

List Price: $26.71

Savings: $26.71(100%)

Book details

ISBN: 1413328202, 978-1413328202

Book publisher: NOLO

Get your hands on the best-selling book Every Airbnb Hosts Tax Guide Maximize Your Income While Avoiding Problems With The IRS 4th Edition for free. Feed your curiosity and let your imagination soar with the best stories coming out to you without hefty price tags. Browse SolutionInn to discover a treasure trove of fiction and non-fiction books where every page leads the reader to an undiscovered world. Start your literary adventure right away and also enjoy free shipping of these complimentary books to your door.

Every Airbnb Hosts Tax Guide Maximize Your Income While Avoiding Problems With The IRS 4th Edition Summary: The complete tax guide for Airbnb and other short-term rental hosts As a short-term rental host, you’re entitled to many valuable deductions and other tax benefits. This book?the first of its kind?shows you how to make the most of your hosting business without risking problems with the IRS Learn everything you need to know about taxes, including: deductions you should be taking how to report your short-term rental income how to deduct losses and vacation home and tax-free rental rules. Whether you rent your property through Airbnb, FlipKey, TripAdvisor, Craigslist, or VRBO, you want to make sure you understand these tax rules, including the new 20% pass-through deduction. This edition includes comprehensive coverage of the Coronavirus Aid, Relief, and Economic Security Act (CARES Act).

Customers also bought these books

Frequently Bought Together

Top Reviews for Books

Jenny Moore

( 4 )

"Delivery was considerably fast, and the book I received was in a good condition."